Start with bad news? Despite the pickup in Chinese PMI, South Korean (bellwether of global demand) export data this weekend raises eyebrows: unexpected drop in May, led by a 9% fall in exports to China. Ouch.

Figure 1. Back to square 1

The good news: a whopping 33% y/y rise in exports to EU, consistent with the recent domestic demand indicators in the euro area – from service PMIs, to last week’s economic sentiment data. True, headline HICP, out this week, will drop a bit to 0.6% y/y (April was boosted by base effects), but 1) widely expected, and 2) should be cycle lows.

Figure 2. Bottoming out

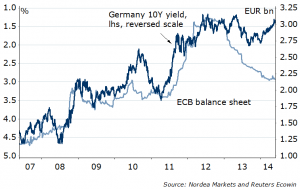

Don’t blame the EUR for the likely 0.2%pt revision in EMU inflation forecast by ECB: it’s almost back to 1.36, where the March ECB staff projections were based on. As long as inflation revision is not larger than 0.2% pts, and only for up to 1Y horizon, the EUR rates and EUR should be supported. Otherwise, a “package” delivery from ECB is broadly expected: a corridor rate cut by at least 10bp, Funding for Lending, extension of liquidity provision…EONIA 1y1y at just 7.5bps, and I would even argue that QE expectations have also been reflected in the recent fall in EUR yields.

Figure 3. QE in the price?

The risks are skewed to ECB doing less. But I have a feeling, I am not alone. Thus action still may work. My hunch is we will get something different, e.g. tweaking forward guidance being more specific. Any explicit reference to output gap and a depo rate cut larger than 10bps is worst that could happen for EURUSD right after. But Funding for Lending, or QE, as I wrote two months back, would very likely lift growth and inflation expectations, and improve risk sentiment – all in EUR favour.

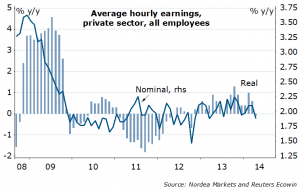

Inflation is in focus in US too. PCE inflation has picked up to 1.6% y/y in April, boosted by base effects (sequester cuts last year). Inflation above 2% is necessary, but not sufficient condition to make Fed tempted to pull the trigger, as they don’t mind some overshooting. With earnings growth stuck at 2% y/y growth, more expensive stuff is not helping the households. Key to watch in this week’s jobs report (consensus: 220k) is definitely wages: only a large pickup in average hourly earnings to above 2% y/y would cause reprising of Fed funds rate up toward Fed’s own forecast… in USD favour.

Figure 4. Stuck in low gear

Technically, however, the DXY seems fading at around 80.50/60 (February, April highs), thus the EURUSD still has a decent chance to come back above the 200D MA: short triggered last week at 1.3620; hold it tight against 1.3685, back long above 1.3730, toward 1.42.

Finally, the market is losing hope the BoJ is not thinking to increase the QQE, inspired by some rumours from the BoJ circles, coupled with the IMF’s message last week. IMF says, also: JPY is “broadly in balance assuming that all three arrows are launched successfully “. Doh…assumptions. If anything, it’s time to contemplate the exit strategy, not necessarily for good reasons: Japan is a great example of wage-growth-less tightening in the labour market. So far, hurting consumers by weakening JPY…and the chart below doesn’t even contain the April data where CPI jumped to 3.2% y/y (ouch).

Figure 5. Bad inflation. Bad.

Technically, the USDJPY is to remain in tight range in coming days, defined by 200D and 50D MAs: 101.40 – 102.20. If ECB does non-conventional easing: expect EURJPY explode higher.

Status quo, GBP, with BoE on hold this week. Some comments from the hawkish BoE members last week – ignore. Carney is running the show, and his was the message from the Inflation report. The GBP remains among the most in G10 universe exposed to risk aversion, and any downside surprises concerning global growth. Long EURGBP is still my choice for the horizon up to 6 months, and short GBPUSD is favourite if DXY breaks above 80.60 this week.