While you were asleep

Brent oil traded above USD 51, holding on to gains after the price briefly dropped below USD 50 on Wednesday for the first time since 2009. It would still be too early to say prices have stabilised.

EUR/USD slipped below 1.18 for the first time since December 2005, heading for its longest stretch of declines since May. Meanwhile, theGerman 10-year bond yield rebounded to 0.51%.

Equity prices rallied strongly (Stoxx 600 up by 2.75%), leaving European equity prices close to where they finished 2014, in part propelled by comforting Euro-area retail sales data as well as comments from Chicago Fed President Evans, a well-known uber-dove. Evans said the US might not hit the Fed’s target inflation rate until 2018, and he doesn’t advise a rate hike until 2016.

The Riksbank’s minutes kept the door open for further easing measures already in February. Flatter rate path, negative rates, LTROs and QE are all still possible avenues, while FX intervention seems unlikely.

As widely expected, the Bank of England made no policy changes. We still expect the first rate hike in June 2015.

The Chinese CPI data showed a modest rebound from 1.4% y/y to 1.5% in December, in line with expectations. Meanwhile, the plunge in oil prices drove the PPI down 3.3% y/y, the lowest in more than two years. Too high inflation is thus not something the People’s Bank of China needs to worry about, when pondering further easing measures.

A poll showed almost 76% of the Greeks want their country to remain in the Euro area at any price, confirming the stance of the Greek people – something that also the next government needs to keep in mind. Unfortunately, the risk of an alternative outcome remains, if the next government tries to overplay its hand in the coming months.

Day ahead

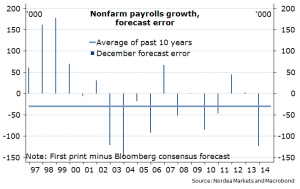

Today’s most important data release is the US employment report. We expect a 220k gain in payrolls in December, somewhat below the 240k consensus estimate. The unemployment rate looks likely to fall to 5.7%, while we forecast a muted 0.2% rise in average hourly earnings after November’s 0.4% increase.

In Norway we forecast an increase in core CPI inflation from 2.4% in November to 2.5% in December, in line with the consensus estimate. If we are right, the market reaction will likely be muted.

Rates

The German 10-year headed higher for the second day in a row and finally ended the day up by 2.5 bp at 51 bp. The curve bear-steepened, i.e. longer yields rose more than shorter ones, and also the 10-30-year curve thus steepened again.

The US 10-year yield has rebounded around 15 bp from Tuesday’s intraday lows, and jumped by 5 bp yesterday, but remains more than 30 bp lower than the highs seen in December. Long yields have more upside left in the near future, if we get even a decent payrolls report today. The 30-year Treasury yield leapt by 7bp yesterday.

Spanish and Italian bonds found demand again yesterday, and both countries saw their 10-year yields end the day lower after three consecutive days of higher yields. A major sell-off is unlikely considering that the ECB is preparing to launch a big government bond purchase programme.

FX

The EUR remains under pressure as the market is increasingly betting on an ECB QE announcement already in January. Recent data has not been EUR-supportive either, with e.g. yesterday’s German factory orders disappointing. The market is currently pondering the 2005 lows of 1.1640. Today’s US payrolls report may be a tad disappointing, but as the Fed has signalled that core inflation is much more important for the rate outlook, this is unlikely to trigger any larger moves.

EUR/SEK dropped temporarily yesterday as USD/SEK faced resistance a touch below 8.00; this resistance eventually gave way, which fuelled a new rise in EUR/SEK. While the SEK is fairly cheap, buyers have to ponder the potential for unconventional easing from the Riksbank in February. So far, EUR/SEK has failed to break below the uptrend since the middle of October (~9.38).

The NOK strengthened yesterday, receiving some tailwind from the stabilisation of oil prices. If Brent oil prices continue higher, the NOK should fare better as well. The 9.00 level remains important. We do not disagree with the consensus about today’s CPI-ATE numbers, but recent NOK weakness could pave the way for higher (NOK-positive) inflation in coming months.

Chart of the day: December payrolls tend to disappoint

Nordea