With major event risks this week – ECB starting QE, and US payrolls on Friday – the stock markets, volatility, could make a major move. How would the EURUSD react to “risk off”?

Last week we saw some negativity in global equity markets, and volatility is not falling to new lows. This environment is generally bad for “high” yielding EM and commodity currencies. It is widely perceived that JPY and CHF are “safe haven” currencies, and so is the USD. The GBP is more risky than the USD. How about the EUR? The EUR used to be very “risky” during the European crisis. But if stocks would sell off globally now, which one is to prevail, the USD or the EUR? (FAQ)

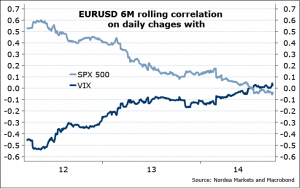

Recent correlation with equities and volatility suggest we have moved from very strong “risky” EUR to more neutral now. Remember the episode in spring this year, where even ECB’s Draghi noted the “safe haven” inflows to the euro zone on geopolitical risks (which helped push the EURUSD toward 1.40). The EURUSD correlation with the stock market is very low now, but it has turned negative – and the direction matters no less than the level.

Figure 1. EURUSD more neutral to stock markets by now

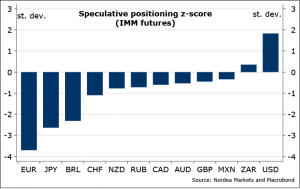

Positioning at each point in time is very important. Usually, at times when volatility increases, the heavy positions in the Markets are shaken. At this point in time, the USD long and EUR short speculative positions are (still) at extremes, and the relative US – EMU economic surprise index spread is high by historic standards, too. This leaves the EURUSD positively exposed to volatility, by definition generated by all sorts of “surprises”, usually negative ones (say, another soft US payrolls report this Friday).

Figure 2. This makes the EURUSD neutral, or positively correlated with volatility

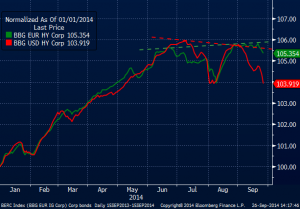

Relative asset performance. ECB is promising loads of liquidity, and this Thursday, the official QE starts. The Fed, meanwhile, is stopping the QE in October. At the margin, it is more challenging for the US stocks (companies need to deal with stronger USD, higher USD rates, and investor nervousness on less central bank support). This may be one of the explanations why the relative cyclical financial equities have stabilized, or turned up recently, just as the US and EMU high yield bonds have diverged a bit.

Figure 3. Relative financials, equities – policy divergence supports?

Figure 4. US high yield corporate bonds have suffered more lately

“Central bank put” matters as well. With the ECB promise to keep rates low for a loooong time, the ECB have trapped themselves into what was Japan’s problem as for many years: years of gradual weakening (JPY as a funding currency), changed by sharp strengthening when positions are reversed. It feels like we are getting there (EUR weakened over summer on low volatility).

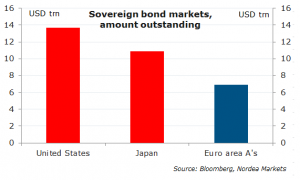

And yet…the US “risk free” sovereign bond market is much larger and liquid than the European. This could be the underlying reason to the relationship – when the US Treasury long term yields go down, so does the EURUSD, as the rush to the US Treasury market supports the USD. This has been the case over the past few months, as if the fixed income market has been preparing for a “risk off” move in equities…

Figure 5. Flows to US Treasuries overwhelm

Figure 6. … as it is still the largest “risk free” market

So, overall, EUR has become a bit of a safer haven now, as correation suggests, given the current positioning, and ECB promises to pump liquidity up. So don’t be surprised by EURUSD holding well on the days of stock market being in the red. It should be the case…until, and unless, it gets ugly, so that the demand for USTs drives the UST10Y yield toward 2% again.

But where will stock market go from here? A trillion USD question. Or EUR. Whichever you prefer now.

Nordea