Beyond doubt this was a more credible stress test than similar exercises done before and the remaining capital needs seem manageable. Banks in the stagnating Euro-area economies may now be more willing to lend, but other obstacles remain. The macro environment will continue to be challenging. There is likely to be some relief in markets in the form of higher equity prices and core bond yields on Monday. Italian bonds should feel some pressure vs Spain and Belgian ones compared to France.

To begin with, here are the key results of the banks’ health check that were published today:

- The vast majority of Euro-area banks withstood the adverse stress scenario with a common Tier 1 equity ratio of at least 5.5%.

- The asset quality review showed non-performing loans of EUR 879bn – EUR 136bn more than previously assumed.

- The stress test revealed a capital shortfall EUR 25bn.

- 25 Euro-area lenders – almost a fifth of the 130 surveyed – failed the health check based on banks’ financial positions at the end of 2013 (9 from Italy, 3 from Greece and Cyprus, 2 from Belgium and Slovenia, and one each from Germany, France, Ireland, Portugal, Austria and Slovenia).

- 12 of the these 25 banks have since covered their capital shortfalls by increasing their capital by EUR 15bn.

- 13 banks still have to raise new capital (EUR 9.5bn) or to follow their announced plans (14 banks according to EBA).

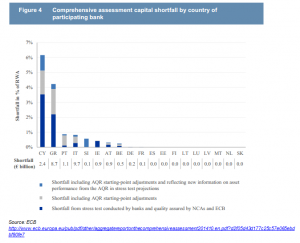

- The EUR 25bn capital shortfall is proportionally highest in Cyprus, Greece, Portugal and Italy.

Banks with capital shortfalls have to submit capital plans within two weeks detailing how shortfalls will be covered in the next six (if they failed the baseline scenario) to nine months.

Further capital requirement manageable

Beyond a doubt this was a more credible stress test than similar exercises done before. The remaining capital need of EUR 9.5bn certainly looks manageable, though some individual banks might find it more challenging. After all, the banks participating in the exercise have raised more than EUR 200bn of capital between 2008 and the end of last year, and a further EUR 57bn this year alone.

Italian and Greek banks with remaining vulnerabilities

The exercise revealed capital needs in 25 banks, but taking into account the capital already raised, the amount falls to 13. Even this number is slightly misleading, as in six of the remaining banks, the capital hole is less than EUR 0.5bn. Only three banks are in need of more than EUR 1bn of capital.

Of the banks with remaining capital needs, only one Italian bank was in the ECB’s categorization of banks with more than EUR 75bn of risk-weighted assets, while none was ranked as a global systemically important bank.

The weakness was relatively concentrated by country, reflecting the differing states of the various countries as well as the fact that several countries had already conducted national exercises to test the state of their banking system.

By nationality, four Italian banks need more capital, two Greek and Belgian banks, respectively, and one each in Austria, Cyprus, Ireland, Portugal and Slovenia. Of the remaining EUR 9.5bn capital need, Italian banks accounted for 35%, Greek banks 28%, Portuguese banks for 12%, Austrian for 9%.

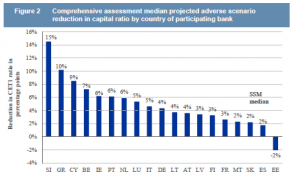

It is also illustrative to look at the reduction in the Common Equity Tier 1 ratio in the stress scenario by country. By this measure, Slovenian banks are by far the most vulnerable, followed by Greek, Cypriot, and Belgian banks.

Source: ECB

Banks now going full steam ahead?

No. If banks want to extend their balance sheet, they need liquidity, capital, confidence and loan demand. The health check was about capital needs and may itself have contributed to subdued lending activity as banks tried to avoid risk at almost any price.

Now that the stress test is over, many banks could be more open towards extending credit. However, mainly due to a lack of demand, we do not expect a strong pick-up in lending.

Economic confidence has clearly increased since the lows seen in mid-2012. Recent setbacks, however, are not likely to reverse quickly. Loans to non-financial corporations contracted by 2.2% y/y in August. The y/y-rate is negative since mid-2012 but the declines eased in recent months. If all goes well, it will probably take a few more quarters until loan volumes increase again. Moreover, a banking sector healthy and robust enough to fulfil its role for the wider economy is a necessary but not a sufficient condition for recovery.

In addition, the changing regulatory environment will certainly change the banking landscape for good. Unfortunately on this front, a lot of uncertainty remains, acting as a further brake for a revival in lending.

Room for some general market relief

The number of banks failing the stress tests was roughly in line with leaked results circulating on Friday. The reaction to these leaks on Friday was a very slight increase in core yields, the value of the euro and equity prices, but the moves were really very limited. Intra-Euro-area spreads still ended the day mostly wider.

As a notable source of uncertainty has passed, there should be some room for a general relief rally in equities, somewhat higher core yields and a slightly steeper curve tomorrow. However, the results are unlikely to change the overall course for the markets: core bonds will remain supported and ECB easing speculation, geopolitical tensions, turns in risk appetite and inflation numbers will continue to be important drivers.

Italy to suffer vs Spain, Belgium vs France

The results should lead to some spread moves in the EUR government bond markets as well. Especially the weakness in Italian banks should incite underperformance of Italian bonds vs Spain. However, Italian banks were expected to be vulnerable in the tests, so the moves are unlikely to be great, while Italian bonds already felt some pressure vs Spain last Friday.

Belgian banks also exhibited clear signs of weakness, and after the strong performance of Belgian bonds vs France lately, the results are likely to lead some underperformance of Belgian vs French government bonds. We would find any such widening a buying opportunity in Belgian vs French bonds, as the French outlook is looking increasingly clouded.

Though the stress test results in our view is way short of critical, issues naturally persist. In this light we remain proponents of front asset swap wideners vs. core govies. Also, and especially with the most recent drops in Eonia’s in mind, we like FRA/OIS wideners near the front of the curve as well.

The next data/events to watch out for are the Ifo index tomorrow, the ECB bank lending survey on Wednesday (telling us more about the demand picture) preliminary inflation data for October this coming Friday, the ECB policy meeting on 6 November and GDP numbers for Q3 on 14 November.

Nordea