The USD (DXY) reversed back to re-test the multiyear downtrend – will it? Lower inflation data could do the trick, but only temporarily. “Tails we win, heads they lose” – commodity FX, now vs EUR.

Reading through just headlines last week, you would have thought we are through another Lehman! But zooming out…

Figure 1. Panic, what panic?

My biggest concern with the situation is that Fed is backing off – most lately, hints of postponing QE – after seeing this minor move above, just 5% stronger USD and 8% cheaper stocks… If anything, it sends a bad signal about their perception on the state of global economy. “The biggest fear

Even though I talked the recession fears myself a weeks ago, it’s not all black: notably, stronger labour market data in many places, pause/end of deleveraging, massive support to consumers from recent drop in commodity prices and interest rate decline. At least short term (could extend to year end) would play for the bounce in risk appetite.

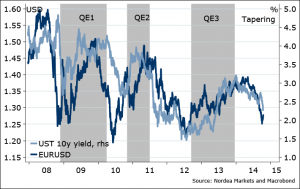

Re-convergence took place, finally, as the US Treasury yields have followed the recent EURUSD move (Figure 2). The USD (DXY) is currently is back at nail edge close to the multi-year downtrend for a retest – a come back to the range this week would see a much sharper and larger correction lower, likely also USD start weakening toward the “risky” currencies. And yet…before we get there, some challenges in the week ahead.

Figure 2. Bottom yet?

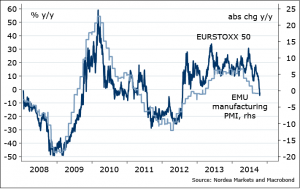

Firsly, the European PMIs. Recent drop in stock prices puts the PMI at a “fair” value for manufacturing PMI close to last month’s levels (50), assuming no further drop in equity prices, but a drop below is a risk (our economists call the below consensus 49). It takes another 10% drop in stocks, I estimate, to see manufacturing PMI at 45 by 2015. That being said, with the recent streak of weak EMU data, a bigger drop needed to surprise on the downside and hurt EUR, and money data suggests PMIs bottom by early 2015.

Figure 3. Mark-to-market

Secondly, the Chinese PMI, IP and GDP data. As emphasized before, if China is doing well, so should the EURUSD, over time (Figure 4), and base case for this week is an above consensus GDP (7.4%), and industrial production should rebound after unexpected contraction in August. The main risk, again, with manufacturing PMI falling below the mark 50 – the data point predictably unpredictable.

Figure 4. Tell me where China goes…

Thirdly, and most importantly now, the US inflation and housing data. Remember I noted the residential investment is as a leading indicator? Well, Fed’s Beige Book last week reflected the weak dynamics in the sector. Weak new home sales this week (only if a give back to last month’s strong gain) will add to the concern. While a lower CPI print (consensus for core: 1.8% y/y) would hurt USD short term (Fed exit delay), possibly bringing it back to the multi-year range…yet over time it will help the USD (risk aversion).

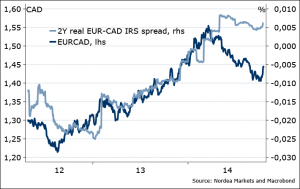

In this environment, stick to the EURAUD, EURNZD, EURCAD longs – these look great also in medium term perspective, and are being hurt by elevated volatility (or, both extremes – sharp moves in “risk-free” rates higher and lower). But rather be neutral or even long commodity FX vs USD short term, betting tactically for risk aversion to recede and commodity prices pick up. The US data worsening is key threat for risk appetite now, therefore I now tactically dislike CAD most on a relative basis.

Figure 5. Some catching-up to do

I would still keep the EURGBP long: “fair value” at 0.8250, terms of trade supportive, this week MPC minutes – no reason for hawkishness with the last wage and inflation prints. Also, start positioning for higher EURJPY. Remember last month I said 104-105 for USDJPY should be about it, as a corrective move? Still holds, but prefer EUR here due still extreme positioning skew.

Nordea