How USD and oil prices relate? What drives the relationship? What to expect going forward?

Even people not dealing with commodities noticed the recent sharp fall in oil prices. They ARE important for monetary policy: energy accounts for 11% of the euro area CPI, 15% of the US PCE basket. So, no wonder the US Fed started to be concerned about the USD strength. Because…currency matters, too!

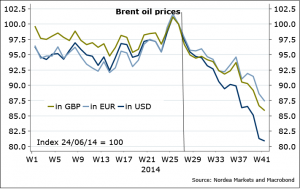

Figure 1. That sinking feeling…

Now the situation is pretty tense: visually, the Brent oil (in USD) is testing multi-year consolidation support, and if it breaks below 88-90 USD/bbl, a drop of at least another USD 10/bbl seems likely.

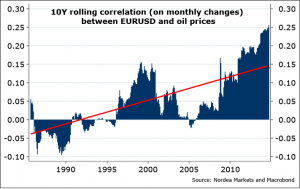

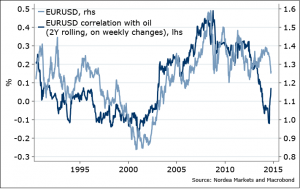

But…what about the EURUSD then? – people ask. Well, the recent fall in EURUSD coincided with the sharp fall in oil prices. Let’s zoom out, and take monthly changes. Indeed, correlation between the EURUSD and oil prices since 80s has been on a mild strengthening trend.

Figure 2. Stronger USD – cheaper oil

Theory? Usually studies find causation to be from oil prices to the USD. Other times, both ways. Why does this relationship exist?

- Reserve diversification. As oil producers, worlds’ major reserve holders, accumulate USD (on higher oil prices), they diversify into EUR (second largest reserve currency) and other FX. This has been the trend over the past few decades. This trend has paused somewhat over the past few years, to USD benefit.

- Global growth prospects. Oil prices decline on growth prospects worsening: notably, the EMU, China, other EMs recently – which, simultaneously force people to buy the US Treasuries, the largest “safe” government market in the world. Hence the USD demand, and strength.

- Monetary policy. The US Fed, the central bank of the USD, world’s major reserve currency, finishes tapering in October and is mulling policy tightening next year. Expectation of higher interest rates is good for the USD here and now, but… less inflation and less growth ahead is discounted in the current oil price.

Shall I continue? Ok, thanks. Then back to empirics.

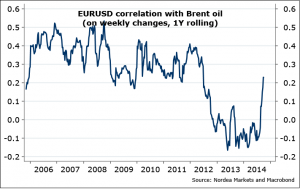

If we zoom in, and take weekly changes instead of monthly, we will notice that during 2012 and early 2014, there was a deviation from the historic trend: correlation between the EURSUD and oil price changes flipped to below zero. It is when people were talking about the US ‘energy independence’, ‘manufacturing renaissance’ and ‘decoupling’. But this was reversed over the past few months – correlation between the EURUSD and Brent oil is striking back to pre-2012 levels. And it probably has reasons to do so.

Figure 3. Positive correlation is back!

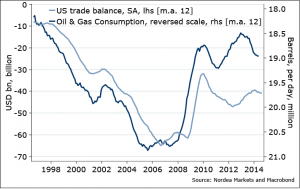

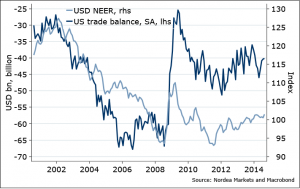

While I do notice positive changes in the US energy production, still think the predominant factor in declining US energy import is weaker domestic demand, as illustrated by Figure 4 below. That is, US consuming less energy as a result of a domestic demand shock (note, household savings ratio rose to 5.4% currently vs 2.5% at the end of 2007). And it that is temporary / cyclical, and we do assume the US households accelerate consuming/dissaving again, the trade balance should start rewidening. Against the USD, if recent history is any guide (Figure 5).

Figure 4. Demand shock improved US trade balance

Figure 5. Narrowing US trade deficit has supported USD since Lehman

And a bonus chart: historically, the relationship is stronger on the upside: the USD weakening is associated with higher oil prices; but upon USD strengthening, correlation is declining and gets weak. It shouldn’t turn much negative. So, if the Brent oil prices find support here, just below the USD 90/bbl, there is a pretty good chance the EURUSD, too, will find a meaningful base around current levels. If not, the EURUSD will go down…but so should its correlation with the oil prices.

Figure 6. Correlation is directional

Nordea