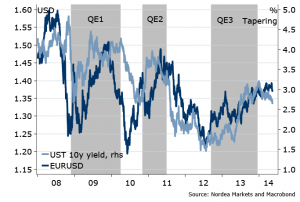

Oh, irony. The US Treasury 10 year yield, breaching 2.5%, well on its way reversing to last year’s taper shock. And that break of that 2.6-2.8% range has been, actually, one of the key drags on EURUSD (sorry, Draghi). I have showed you this before…

Figure 1. UST yields and EURUSD – who knew…

People scratching heads, why? A major part of that decline in US and other yields globally is that, my view, the recovery, especially in US but also China, has not been as strong as people had anticipated at the beginning of 2014. The EMU GDP growth of just in Q1 reported last week was a miss too, with under 1% annualized rate…but note, US’ Q1 growth much worse: may be revised to lower than -0.5% (annualized). Plus, Chinese figures softer again last week, as domestic demand dampened by slowdown in housing market. That’s when you get these WSJ headlines…

Figure 2. Scarying Americans

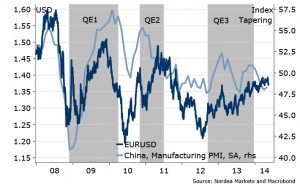

Why China matters so much for EURUSD? My sense is that ECB started to become louder about EURUSD since CNY started to weaken. No wonder – CNY is currency of the single largest trading partner (18.7% weight in ECB’s effective EUR index), thus weaker CNY puts euro area competitiveness at risk. In addition, China is the key source of global growth, accounting for 30-40%, so it is a major determinant of the euro area recovery, and thus risk to the EUR. This week Chinese PMI is out – fingers crossed – guesstimate is a slight increase.

Figure 3. EURUSD and China’s growth…who knew (2)

It ain’t over until it’s over. The EURUSD has breached the 1.3730, which I said was a stop level, and the next key support is around 1.3630 (200D MA). It still seems the USD is not done weakening and is overextended: DXY and DJ USD indices hitting multi month channel resistances here. I would recommend to be back long EURUSD at above 1.3730 (77% chance we get there within 2 weeks. Hint: I had a dream), and consider shorts only below 1.3620 (that’s e.g. if China data disappoints hugely, UST 10Y yield toward 2.20%, and below). European PMIs out this week too, so far indicators suggest a flat reading, or only a minor decline, shouldn’t be an issue.

Figure 4. Time to put itself together, or else…

Another focus week for the GBP, as inflation figure is out. Indicators suggest unchanged or slightly higher (up from 1.6% y/y last month), consensus is for up…beware. Wage growth was a disappointment last week. This no wonder the BoE Inflation Report was on the dovish side: no revisions to the “total slack” estimate (1-1.5%), declining medium term unemployment rate (!), and global growth sustainability concern. The GBPUSD managed to get support at the uptrend channel, but looks weak against other major currencies…Thus no change in bias: be short (vs CAD, SEK…), except for against USD.

Otherwise, quiet data week ahead. “Muddling through” continues, not in USD favour. Positions same – including long AUDNZD (all horizons), short USDCAD (tactical, Canada inflation should be up to target this week). Now that the USDJPY is toying with key support at 101.50 (descending triangle – bearish) and UST 10Y yield has breached the range down…play USDJPY for the downside, if anything.

Nordea