Moving beyond the very big-picture issue of the perception of the euro as a harder or softer currency, what are the key issues for the next three-six months? We think there will be three main driving forces for EURUSD:

1. Dollar direction globally

…As we establish a 3% growth trend in the US economy, which will probably be the situation by end Q2, it is very possible that the Fed will be ready to send a different signal during Q3. This may mean that we are a few months away from a clearer dollar-appreciation trend.

2. Capital flows to the Eurozone

We have been writing a lot about strong portfolio inflows into the eurozone over the past 12 months. Initially, this was driven mainly by equity inflows, but lately strong inflows into peripheral bond markets, and additional support from Russian funds seeking a refuge in Europe, have also played a role. We have had the view that these flows could peak during Q2, but our high-frequency indicators still look fairly robust, so we have no strong reason to call for a big change yet. For example, equity flow momentum may have moderated a touch, but it has not turned in a dramatic fashion, and our bond indicators, as well as the momentum in Chinese reserve accumulation, suggest that support for the euro could last some additional months, unless the ECB really sends a different signal.

3. The signal from the ECB (softer euro?)

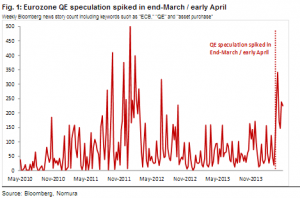

The wild-card is the ECB, and whether a regime shift is potentially around the corner. Mr. Draghi has managed to drive the euro lower by pre-announcing the June easing. But what form this easing will take is crucial and remains uncertain.Conventional easing, including a deposit rate cut, seems priced in, with a very high probability, and will not in itself move the euro substantially from current levels, in our view. Quantitative easing, either announced or pre-announced, would be a different matter, however. It would potentially constitute an important regime shift, a signal that the ECB is uncomfortable with the deflationary bias involved in ruling out QE and other non-conventional policy tools. Such a signal would likely mean that some of the “hard currency premium” currently embedded in the euro will be priced out.