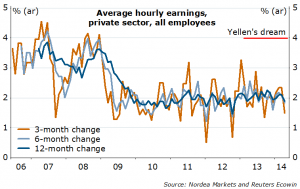

A happy hour for the USD bulls after Friday’s US payrolls report. Sorry. This time was not different. While the jobs number good on the headline, the guts, especially the still low earnings growth, means patient Fed – Yellen’s semiannual Testimony this week. Remember Bernanke’s one causing taper shock last year? This time will be different.

Figure 1. Not there yet

USD will resume broad decline short term (also EMs, commodity FX), as the data from the US and the rest of the world is still ok, and it should be good enough to maintain sentiment in the near term. One worry, though, from the US Q1 GDP report last week, residential investment disappointed big time. To me it rang a bell: recalled a great paper from the 2007 Jackson Hole: housing IS the US business cycle. As housing goes – so goes US economy. And, weirdly as sounds, bad news is USD’s key hope now. Keep an eye on housing data. Just saying.

Figure 2. Oops…

Smug ECB is expected this week. 2/58 analysts expect a rate cut (Bloomberg survey), and rightly so few. Liquidity front is under control: with the help of automatic stabilizers last week (SMP failure, huge MRO uptake), excess liquidity is back to the comfortable above EUR 150bn. EURUSD well anchored. Friday’s payrolls did push the USD money market curve up (e.g. USD OIS 1Y1Y jumped 8bps), but not the EUR (1Y1Y OIS ended even lower for the day) – I already hear Dragi say: “see, forward guidance works!”. Inflation is up from lows, and good news from Euro zone lending survey last week: finally, the demand side is catching up. So why act? Keep the EURUSD long for a run to above 1.40, SL 1.3720.

Figure 3. Better later than never…

Oh not again, media: “sterling strengthens on … “ – from GBPUSD alone. Well, even the EURGBP was barely changed for the week despite the miss on EMU inflation figures. Deal with that. The UK construction PMI last week was still sky high, but the lowest pace for six months, and voila – a disappointment. The Q1 GDP, at a high 3.1% y/y rate, still missed the BoE’s hope of 3.5%. The BoE meeting this week is likely to be no big deal; key next will be the Inflation Report (May 14th), that’s where more details will be provided. Net long GBP speculative positions are highest among G10. Yes, the GBPUSD has a chance short term (test 1.70), but most other GBP crosses not. Keep the EURGBP long for now, among others (SEK, CAD, AUD…).

Optimists, the BoJ, expect core inflation to reach 2% next year. Well, as the JPY effect wanes, that could be a bit of a challenge, with the lack of wage growth and lower consumer confidence. BoJ’s Kuroda remains positive, judging from last week’s BoJ meeting comments, as the VAT tax hike effect was in line with their expectations. This means the chances of additional QE / QQE remain limited for now. For the USDJPY to break out of the range, either Japanese stocks need to drop or rise sharply, or the USD yields have to move big in one way, and last week’s move in UST 10Y yield suggests more downside is likely in the short term.

Figure 4. Even at current JPY levels, 2% may be off

Figure 5. Key “driver” diverging…

Be careful out there.

Nordea