After some early gains, bonds ended the day with losses yesterday on both sides of the Atlantic. The German 10-year yield rose by 3bp, while the corresponding move up in the US was around a bp. Intra-Euro-zone spreads widened further, but the moves were not huge.

Bonds are likely to find some support again today and yields edge slightly down ahead of the weekend.

US equities showed improving performance almost throughout the day, and S&P 500 ended the day higher by 0.60%. Important resistance levels (record highs) are looming, so another important test lies ahead. European equities were mostly flat, but are set to open higher today. Apart from China, Asian equities are trading up this morning (Japan higher by 2-3%).

Euro-zone PMIs finally feeling some pressure

The Euro-zone composite output PMI corrected slightly lower from 52.9 to 52.7, driven by a fall in the manufacturing PMI. Still, the index remains at a decent level. The manufacturing component retreated from 54.0 to 53.0, not that surprising after the weaker confidence seen in the US and China, while the services index actually edged marginally higher.

By country, Germany was supported by a strong services index, while French confidence weakened clearly overall. The French economy thus continues to struggle, putting pressure on President Hollande to do more to improve the French outlook.

Fitch keeps Austria AAA – no changes to the Irish rating either

The rating agency Fitch kept its AAA rating on Austria unchanged and also maintained the stable outlook. This affirmation was made despite the fact that Fitch noted the restructuring of Hypo Alpe Adria bank would likely lift government debt more than previously expected, by EUR 18bn or 5.6% of GDP in the new forecast by Fitch. The agency said that further bank costs for the sovereign would be limited, while Austria’s relatively favourable public debt dynamics, including stronger growth and low fiscal deficits, should remain intact.

The affirmation by Fitch was certainly good news for Austrian bonds, but with Moody’s having its turn already next Friday, the near-term risks have not disappeared, which also means there may not big that big of a market reaction to the news today. Anyway, Fitch has the most positive view on Austria of the three major agencies, as Standard & Poor’s has already downgraded the country, while Moody’s has a negative outlook.

Fitch also affirmed its BBB+ rating on Ireland with a stable outlook. Later today, Moody’s has a chance to review its Baa3 rating (stable outlook) on Spain.

Conflicting signals from the US

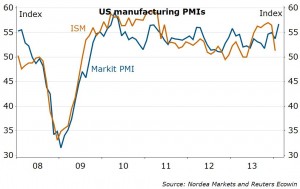

To increase confusion about the state of the US economy, the February flash manufacturing PMI surprisingly jumped from 53.7 to 56.7, the highest in almost four years, suggesting the ISM index could also see a big rebound after the January plunge. Both output and new orders rebounded sharply. However, the two indicators have not been moving very closely together in the past, while the manufacturing ISM is the more established indicator, so one should not turn too optimistic based on the Markit PMI data.

The Philadelphia Fed manufacturing index, in turn, did not point to a quick rebound in the ISM. The headline index slumped from 9.4 to -6.3, a 1-year low. However, the 6-month ahead confidence index actually improved, suggesting the fall in the headline was weather-related to a large extent.

US existing home sales ahead

The highlight in today’s calendar will be the US January existing home sales data at 16:00 CET. Needless to say risks are on the downside. In the UK, January retail sales will be released at 10:30 CET, while the latest ECB LTRO repayment data at 12:00 CET will also gather some attention. In addition, the Fed’s Bullard will speak at 19:10 CET and Fisher at 19:45 CET.

Looking ahead to the weekend, the G20 finance ministers and central bank governors will meet in Sydney. Among the topics to be discussed are the situation in the emerging markets and the effect US monetary policy is having on these markets.

Do you see a discrepancy?

Nordea