Forecasting. It’s amazing how we always find “obvious” explanations for something…but only after it has happened. Weak payrolls on Friday are being shrugged off on weather en masse. Even the steep fall in participation rate: now they say it’s population ageing, but where were they several years back when even CBO were forecasting it at 63.2% only in 2020 (vs now 62.8%)?!

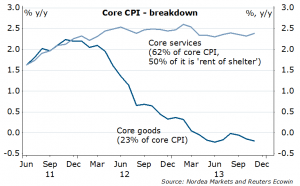

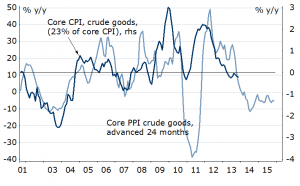

Weather or not, the payrolls report does not support accelerating Fed (>10bn/month tapering) as a minumum for now, and leaves many optimists hoping for big upward payroll revisions next month. From Fed’s minutes last week it is clear that inflation is their main concern. Just in time, the US CPI is out this week: consensus is looking for a 0.3pt rise in y/y headline, stable core. As it looks now, core inflation hinges on services, and in particular rents (50% of core services), with no upside pressure from core goods (PPI, FX-relevant import prices) for as far as the eye can see. With the overall optimistic expectations for the US economy ahead, and US macro surprise index highest among G10, it doesn’t take much to bring the USD lower shortly – weaker inflation or retail sales this week could do the trick.

Figure 1. US Core CPI – up mostly on rents

Figure 2. No upside pressure for core goods

Relaxed ECB with a look-through at the softer December CPI print (Germany, as always, to blame). “Other downside risks (to growth) include higher commodity prices” (Draghi) – not a hint against EUR. High bar for ECB to act: cyclical European data keeps improving (PMIs, industrial production, retail sales and economic sentiment data – all came out strong) and, most importantly for ECB, inflation expectations stable (e.g. swap break-even 5y5y at 2.28%, 20bp up from November lows, so is 2y2y). Watch the money market rates normalize, as the excess liquidity flush, which pushed the EUR lower over the year turn, is being absorbed by regular operations. Stay long EURUSD (opened at 1.3450), aim for EURUSD to 1.3850, then above 1.40.

Figure 3. Third bounce from 100D MA, and off toward 1.3850.

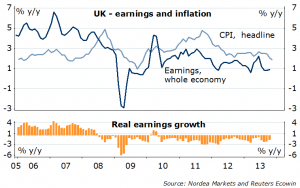

Who hits first? With the US unemployment rate 0.2ppts away from Fed’s threshold (6.5%) and UK’s just 0.4ppts away (7%) – a question of just a few months. It is important to what extent Fed’s and BoE’s communication will change, and here wages/inflation is key variable (hint on where the output gap is). Remember, the US inflation is lower, but if we do get more disinflation in the UK (down from 2.1% y/y – previous) as some indicators suggest (CPI out this Tuesday), it will harm the GBP. With the expectations pricing (hike this year!), the EURGBP upside is more likely than the downside in the short term. (0.8200/50 strong support).

Figure 4. No inflationary pressure in UK just yet – degree of freedom to BoE

The USDJPY short, which I intentionally placed at 105 before payrolls Friday, has performed on the drop in UST 10Y yield – expect more of the latter. Risk sentiment – stocks – is a wild card though, and we need to see a correction to get the JPY stronger. Any weaker than expected Japanese data (this week: consumer spending, machinery orders) would question the success of Abenomics and would (counter-intuitively as it may sound) strengthen the JPY.

Otherwise, heads up for the trades of the year 2014 sent out last week, will keep you updated when changes, and happy to elaborate more (hit me). So far… so good 😉

Nordea