Interest rates have been defying gravity for 1.5 months already. Even though the sell-off started from exceptionally low levels and is not totally without merits, we find it is looking increasingly overblown, especially in Europe. We thus look for a notable move back lower in rates, with the Fed meeting next week being a potential trigger.

The main driver for higher rates has been the continued improvement in US labour markets and its impact on Fed expectations: the Fed is now expected to start scaling down (i.e. tapering) its bond purchases sooner rather than later. While we agree that the timing of the Fed tapering is approaching, now is not the time to signal such a move. Our point is that Fed could await and watch how the economy develops over the summer – then, if necessary, signal an appropriate adjustment of its current asset purchases.

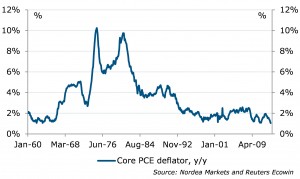

The Fed is unlikely to want to feed a further rise in rates, considering the big moves we have already seen, nor put further pressure on equity and credit markets (remember the Fed’s history and Bernanke put). Even though labour market conditions have clearly improved, the other part of the Fed’s mandate, i.e. price stability, has become a topic again.

In fact an increasing number of Fed members have become somewhat concerned about the slowing inflation, which should not be a big surprise considering the fall in the Fed’s preferred inflation measure (core PCE deflator) to a 60-year low (in y/y terms). This could also be reflected on the statement next week, which in any case is unlikely to meet the rather hawkish expectations illustrated by the recent market moves.

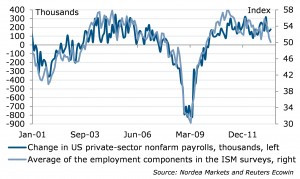

In addition, the payrolls numbers could easily take a turn for the worse in the near future. The payrolls report is hugely volatile in nature, while e.g. the employment components of the ISM indices and the ADP employment survey have pointed to weaker development than seen lately in payrolls.

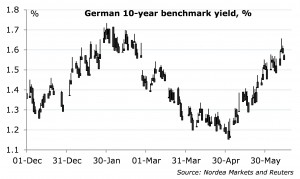

Turning to Europe, not much has changed since the yield lows seen in early May. Sure, we had somewhat better PMI data, but the recent manufacturing PMIs from China and the US point to weakening global growth momentum in the near term, something that Europe is far from immune to.

The ECB’s stance has not really changed. There were voices calling for easy monetary policy already at the June meeting, while the central bank remains open to even negative deposit rates. The ECB is not out of ammo and stands ready to deliver more, if the data take another turn for worse. In any case, ECB’s policy looks set to remain accommodative for a very long time.

We do note that being long the short end of the curves has been a very crowded trade, while the increased volatility seen lately has made the roll positions look less attractive. While we do not expect this volatility to subside, the higher rates are likely to attract plenty of buying/receiving interest again as soon as we see signs of the sell-off abating.

The Fed’s preferred inflation measure fallen to record lows

ISM employment indices point to downside risks for payrolls

PMI momentum not looking particularly strong

Does the Fed want to strengthen these moves?

German yields remain in range – tentative signs of stabilization

Nordea