If you wish to receive Nomura Global Markets Research pdf reports (and many other analytics) on a regular basis, subscribe now or get a free 5-day trial.

Nomura Global Markets Research: FX Insights – Trump traking: The “eye of the storm” moment?

Political uncertainty is always on the horizon, and one thing we’ve learned in 2016 thus far is politics has stumped the consensus on FX. November may have a few key events: the UK is likely to have its first “post-Brexit” budget, Italy will hold its constitutional referendum (possibly 6 November) and of course there is the US Presidential election (8 November). So we may reflect back on this post-Brexit summer period as the “eye of the storm”. That is the calm region at the centre of a storm, followed soon after by its most damaging winds and intense rainfall. Could Donald Trump provide that? His tax cuts could provide a boost for risk assets, but trade rhetoric could see MXN, CAD, CNY and US trade-dependent currencies significantly underperform. Mr Trump’s chances of victory are following a similar pattern to that of what was the “unlikely probability” of a Brexit. For US presidential elections, what can be telling tends to be the swing state polls where the tracker metrics show Mr Trump’s chances have improved considerably of late. Winning the Presidency without also winning Florida is very rare. Since 1960 this has happened only twice. Interestingly, the last time it happened was in 1992, when a Clinton was on the ticket. The probability of Mr Trump winning Florida stands at 49.6%; it’s tight.

The Trump-implied probability is rising

FiveThirtyEight’s 2016 US election forecasting model is likely to be one of the market’s first ports of call for interpreting the likelihood of a Trump presidency as we approach the 8 November election date. It keeps a rolling update on the polling, collected by RealClear Politics and other sources, then weights accordingly each poll by analysing the historical accuracy and methodology of each firm to produce a probability of a Trump win (see Figure 1). There are three main models that they quote, overall showing that Mr Trump’s chances cannot be “written off” yet.

Fig. 1: Just because the probability is low, doesn’t mean it can’t happen

As we have seen with political binary events before, as long as the probability of the “market negative” stays well away from the 50% level, the overall market pricing of the event will remain limited. However, the ebb and flow of price action could start to become sensitive to it, especially if the market believes the implied probability (after a political event for example) could be higher than polling suggests.

Nomura Global Markets Research reports are available to our subscribers.

Subscribe now or get a free 5-day trial.

Keep an eye out for the swing states or “tipping points”

It is clear that the Republicans are at an Electoral College disadvantage. This is why, when there is only a few percentage points’ difference between Donald Trump’s polling and Hilary Clinton’s, it still translates into a relatively small probability of a Trump victory. The election forecasting is a product of both national and state-wide polling. State polling on an individual basis is interesting but not necessarily telling for the national outcome in all cases, especially if polling is tight. What will be interesting is the state of polling in the “swing states” where it’s not clear which candidate should win.

Fig. 2: Donald Trump’s chance of winning is non-trivial

Fig. 3: Swing states to watch

We advise keeping an eye on the “tipping point states” that carry the highest Electoral College seats so also carry with them a possibility of tipping the election either way. FiveThirtyEight put the probability of Florida providing the decisive vote in the Electoral College at 17.1%; combine that with Ohio (11.3%), Pennsylvania (11.7%), Virginia (7%) and North Carolina (6.5%), and you have a probability in excess of 50% that one of these will be the state to “tip the election”. Winning the Presidency without also winning Florida is very rare. Since 1960 this has only happened twice. Interestingly, the last time it happened was when Bill Clinton was on the ticket in 1992. Mr Trump is currently predicted to lose Florida but, with FiveThirtyEight putting the probability of a win at 49.6%, it’s still to play for.

Fig. 4: Donald Trump has a chance in Florida and Ohio, which could “tip the election”

Even though it’s “unlikely”, when it comes to politics it’s prudent never to rule anything out

Polling is not a perfect science. Brexit was an example of that, with many other examples over the years. The argument in favour of political polling for the US election though is that there is a lot of historical data to work with (as this is a recurring event) and forecasters have learned from the errors of past. However, Donald Trump’s campaign has consistently surprised political forecasters, who did not expect him to win the Republican nomination in the first place. So could it be that, as with the Brexit polling, there is a factor that pollsters are missing?

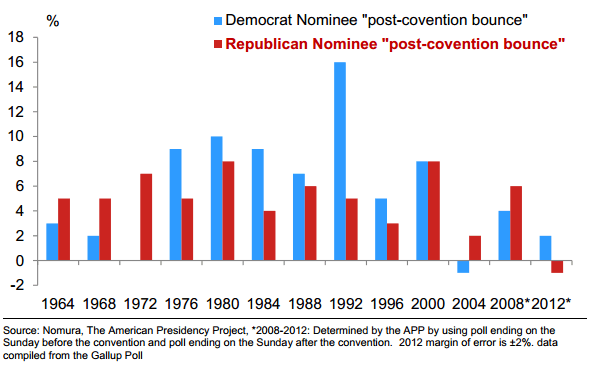

Watch out for the possible Republican convention bounce

This week has seen the start of the Republican convention and Donald Trump formally nominated for president by the Republican Party. There is typically a “convention bounce” in the polls for the candidate in the weeks following that is worth taking note of. It doesn’t always happen. Mitt Romney’s experience in 2012 is an example of that, where forecasters were looking for a 4% bounce, but instead saw a 1% decline in support. Nonetheless, the broader historical evidence is convincing, so any pick-up in Trump support following the convention should be taken with a pinch of salt, unless it becomes a persistent level of higher Trump support.

Fig. 5: The post-convention bounce in voter preference

What a Trump presidency would mean for markets

A Trump presidency could lead to market uncertainty; we focus on the trade aspect

Donald Trump, with Mike Pence as his running mate, will be on the ticket come 8 November with a “non-trivial” chance of becoming the next President. There is no justification then for dismissing the potential impact of a Trump presidency on markets, especially when some of Mr Trump’s “positions” would have potential trade impacts.

The market reaction would not be across the board “risk-off”

It is not immediately clear what a Trump presidency would mean for risk markets. Mr Trump’s original tax plan had sizeable tax cuts (see here), although his team plans to release an updated tax plan soon, perhaps even this week at the convention, so this could be revised. Nonetheless, if it looks something like that of a typical republican tax cut plan, would it not be a fiscal stimulus to the benefit of US equity markets?

An argument against the “doom and gloom” view is that if Mr Trump were to win the Presidency, it is likely that in the process of doing so he may have “softened” some of his extreme stances. This may turn out to be true, but he has repeatedly pointed out his intention to declare China immediately a “currency manipulator”, to “build a wall” and reminded us that he is prepared to “rip up NAFTA”. Even if he were to achieve just one of those it would still have a profound impact on the respective markets.

Therefore, as we explained in Trading the Trump factor (6 June 2016), rather than trading broad risk assets in the event of a Trump win, we judge it is the US tradedependent currencies of MXN, CAD, CNY and Asia that would underperform.

In terms of events to come, we have the Democrats convention on 25-28 July, but then it should be relatively quiet before the TV debates start on 26 September which should signal the more intense campaigning period.

You can get Nomura global markets research reports as well as many other valuable research from major investment banks via our subscription.