If you wish to receive Credit Suisse technical analysis pdf reports (and other valuable research) on a regular basis, subscribe now or get a free 5-day trial.

Credit Suisse FX Daily

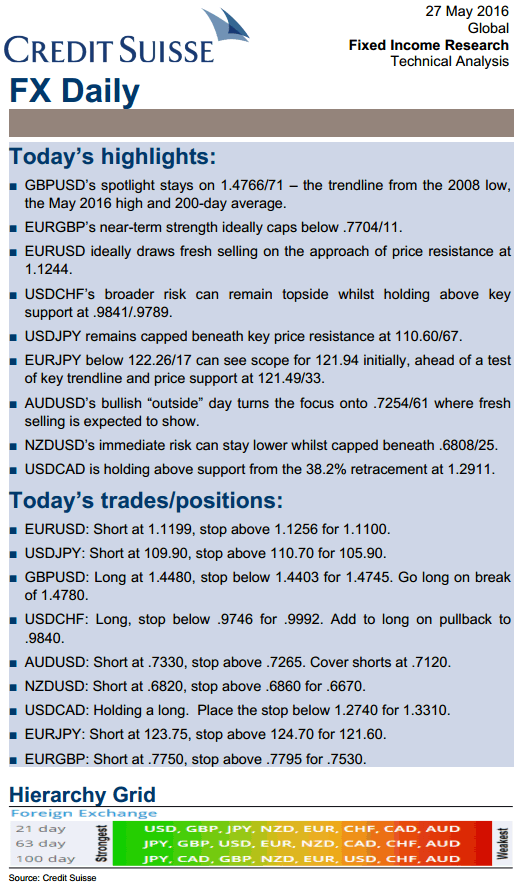

Today’s highlights:

■ GBPUSD’s spotlight stays on 1.4766/71 – the trendline from the 2008 low, the May 2016 high and 200-day average.

■ EURGBP’s near-term strength ideally caps below .7704/11.

■ EURUSD ideally draws fresh selling on the approach of price resistance at 1.1244.

■ USDCHF’s broader risk can remain topside whilst holding above key support at .9841/.9789.

■ USDJPY remains capped beneath key price resistance at 110.60/67.

■ EURJPY below 122.26/17 can see scope for 121.94 initially, ahead of a test of key trendline and price support at 121.49/33.

■ AUDUSD’s bullish “outside” day turns the focus onto .7254/61 where fresh selling is expected to show.

■ NZDUSD’s immediate risk can stay lower whilst capped beneath .6808/25.

■ USDCAD is holding above support from the 38.2% retracement at 1.2911.

Today’s trades/positions:

■ EURUSD: Short at 1.1199, stop above 1.1256 for 1.1100.

■ USDJPY: Short at 109.90, stop above 110.70 for 105.90.

■ GBPUSD: Long at 1.4480, stop below 1.4403 for 1.4745. Go long on break of 1.4780.

■ USDCHF: Long, stop below .9746 for .9992. Add to long on pullback to .9840.

■ AUDUSD: Short at .7330, stop above .7265. Cover shorts at .7120.

■ NZDUSD: Short at .6820, stop above .6860 for .6670.

■ USDCAD: Holding a long. Place the stop below 1.2740 for 1.3310.

■ EURJPY: Short at 123.75, stop above 124.70 for 121.60.

■ EURGBP: Short at .7750, stop above .7795 for .7530.

You can get Credit Suisse technical analysis reports as well as many other valuable research from major investment banks via our subscription.