If you wish to receive this report (and many other) on a daily basis,

subscribe or request a free 5-day trial.

FX Thoughts for the Week Ahead

From one anxiety to another

Growing concern about Chinese economic activity has left FX markets little time to consolidate following the recent conditional agreement between Greece and its creditors. Much like the well-known “whack-a-mole” game, one source of volatility and anxiety has been quickly replaced with another. Following the sharp decline in Chinese equities in June and early July, indicators of Chinese activity have begun to deteriorate with last week’s July manufacturing PMI falling to a 15-month low, deep into contractionary territory and disappointing market expectations by a large margin (China: July ‘flash’ PMI plunges unexpectedly, 24 July 2015). Commodity prices and related currencies such as AUD, NZD, CAD and NOK have fallen significantly over the past month. We continue to expect further commodity currency weakness amid a relatively unsupportive risk environment and our greatest conviction lies in additional AUD downside from still-overvalued levels (~10%). In contrast to the RBNZ, which cut its policy rate by 25bp last week to 3.00%, the RBA appears unwilling to deliver necessary monetary stimulus given financial stability concerns related to rapidly rising Sydney house prices. As such, the currency will likely have to do the work and we continue to recommend being short AUDUSD targeting 0.7000. (See Macro Daily Focus: Commodity currency contagion, 15 July 2015).

USD strength has been another important theme for FX markets over the past month and should be underscored this week by the FOMC rate decision and Q2 GDP data. Although not committing firmly to a September rate hike (our call, versus market pricing of January 2016), given recent market volatility related to Greece and China, Wednesday’s FOMC statement should reflect the recent US economic data strength. Indeed, data released on Thursday should reveal above-consensus US Q2 GDP growth of 3.0% q/q saar, driven primarily by strong consumption growth and a boom in residential investment. Overall, we think the USD should appreciate in both “risk-on” and “risk-off” states of the world. In “risk-on” states, superior US economic fundamentals are likely to support higher returns to capital and currency appreciation. In “risk-off” states, the USD is likely to be supported by its highly attractive safe-haven attributes including low volatility in asset returns (see Three Questions: Top dollar, 4 June 2015).

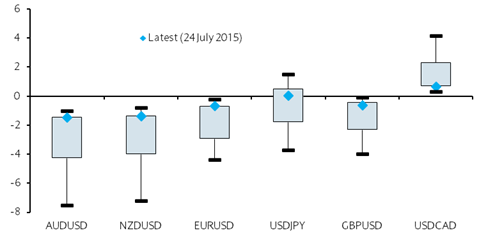

FX option markets suggest USD long positions have become surprisingly cheap. Indeed, 3-month 25-delta risk-reversals across liquid G10 currencies, excluding the JPY, suggest USD calls are now close to their deepest discount versus puts, based on data since 2010 (Figure 1). As such, we think this is a particularly opportune time for investors to express a long USD view via options given our expectations of US data/events this week and broader bullish USD view. While we expect continued commodity currency weakness against the USD, our forecast for extremely low euro area inflation (Friday) and sub-consensus UK Q2 GDP (Tuesday) should also provide a catalyst for further EUR and GBP weakness versus the USD.

Several EM central banks are scheduled to meet this week. In EMEA, BoI is widely expected to leave policy settings unchanged on Monday while we and consensus expect the CBR to slow the pace of easing and lower its policy rate by 50bp to 11% on Friday. In LatAm, we and consensus expect the BCB to hike the Selic rate 50bp on Wednesday. Banxico is likely to leave rates unchanged on Thursday amid all-time low inflation.

Figure 1: G10 3-month 25-delta risk reversals

Note: Data since Jan 2010. Dashes show max and min, boxes cover 10th to 90th percentile.

Source: CFTC, Bloomberg, Barclays Research

Trade for the week ahead: Buy the EURUSD 3m 25d risk reversal (buy the put, sell the call)

As discussed above, USD calls have become extremely cheap and we recommend expressing our bearish EURUSD view by buying the 3-month 25-delta risk reversal (buying the put with a strike of 1.0584, selling the call with a strike of 1.1389, spot reference: 1.0964) for 11bp. Our technical strategist is also bearish EURUSD and looks for selling interest near 1.1050 to cap near-term upticks. A move below support in the 1.0810 area would confirm a top under the 1.1470 range highs and signal further downside traction. His initial targets are towards 1.0675 and then the 1.0460 year-to-date lows. His greater downside targets are in the 1.0200 area (Figure 2).

Figure 2: EURUSD from a technical perspective

Source: CQG, Barclays Research.

What to look for this week

USD: A more optimistic outlook

The FOMC rate decision (Wednesday), first Q2 estimate of GDP (Thursday) and Employment Cost Index (Friday) are the main events for the week ahead. The FOMC statement should not present material changes, but risks are tilted towards a more optimistic rhetoric as recent economic data have improved and near-term risks regarding Greece have receded. The Employment Cost Index should shed some light regarding wage pressure (Barclays and consensus: 0.6% q/q, 2.4% y/y), as it is one of the measures that better correlates with core inflation. On top of this, we expect the first estimate of the Q2 GDP to confirm that Q1 weakness was influenced by transitory factors. We anticipate an above consensus 3.0% q/q growth (consensus: 2.5%) with consumer spending advancing at a 2.7% rate. This suggests that the USD will likely continue with its upward trajectory, having an additional support from soft commodity prices and a slowing China.

EUR: Extremely low inflation to drive further currency weakness

Euro area flash July HICP inflation (Friday) should confirm extremely low inflation and support the ECB’s continued commitment to its Public Sector Purchase Programme (PSPP). We forecast HICP and core inflation to have eased 0.1pp to +0.1% (consensus: 0.2%) and +0.7% (consensus: 0.8%), respectively. Indeed, we think that the ECB will continue its monthly asset purchases at the same pace until September 2016, and probably even longer as we believe the increase in inflation will likely be slower than the ECB currently projects. Moreover, we believe that the chance that additional measures will be announced by the end of this year is non-negligible and will depend on financial market developments, especially in conjunction with upcoming discussions about the third Greek bailout (see ECB committed to fully implementing QE, 16 July 2015). As such, we continue to expect substantial EURUSD depreciation over the coming year as ECB monetary policy diverges materially from that of the Fed’s and a large degree of economic slack weighs on euro area returns to capital (see FX Themes: A weaker EUR, at the core of our views, 25 June 2015).

GBP: Q2 GDP in focus

In an otherwise quiet week for UK data and events, focus will centre on UK Q2 GDP (Tuesday); we forecast 0.6% q/q growth, slightly below the consensus forecast of 0.7%. Wednesday’s lending report may also gain some attention. We expect mortgage approvals to edge up slightly in June to 66.5k (consensus 66.0) and mortgage lending to increase to GBP2.2bn (consensus: GBP2.0bn) in line with BBA data released on Friday. Meanwhile, we and consensus expect consumer credit to increase GBP1.1bn.

GBP FX and rates have been volatile over the past month, driven in part by the media’s more hawkish reporting of recent BoE communication (for example, Carney’s comments at the BoE Inflation Report Treasury Select Committee hearing) and disappointing economic data (for example June retail sales). Overall, we remain comfortable with our view of modest GBP outperformance versus the EUR but material depreciation against the USD. The BoE MPC vote for rate rises remains 9-0 against. While some members (Martin Weale, for example) are moving closer to a voting for tighter policy, inflation remains nonexistent and will likely only reach 0.3% y/y by year-end. As such, it will likely take until Q1 next year before the majority of the committee agree to hike the Bank Rate. Furthermore, tight fiscal policy and downside risks to business investment and confidence related to the EU referendum mean that the likely pace of policy tightening will be extremely moderate once it begins.

JPY: Eyes on Japanese data and politics, but focus remains on the Fed

USDJPY remained range-bound around 124 last week after rebounding sharply from 120 on receding Greek concerns. Recent price action has been consistent with our view that USDJPY should oscillate around 123 with risks on both sides. Upside risks include a bringing forward of Fed hike expectations and downside risks include a deterioration of risk sentiment (see Global FX Quarterly: In the dollar we trust). Having said that, Japan factors have become less supportive of the yen recently, including slowing economic activity, decelerating core CPI, and a sharp drop in approval ratings of the Abe administration.

Economic data have disappointed lately, suggesting that Q2 GDP will contract and y/y core CPI will likely to turn negative again over the summer/fall. In this light, the June Household survey (Friday), June Industrial Production (Thursday), and June Core CPI (Friday) will demand some attention this week. We expect June real household spending to increase +2.8% y/y (consensus: +1.9%), the second consecutive month of positive y/y growth. We forecast June Industrial Production to increase +0.1% m/m (consensus: +0.3%), but translates to a 1.8% contraction in Q2 as a whole. On inflation, we look for June core CPI to stay at +0.1% y/y (consensus: 0.0%) from +0.1% in May. Furthermore, major polls show that approval rating for Abe administration plummeted to sub-40%, the lowest rating since Abe’s inception in December 2012, likely over the controversial security bills. A combination of worsening economic activity, decelerating core inflation on the back of falling oil prices, and a deteriorating cabinet approval rating suggest that there may be less incentive for political jawboning against yen weakness than there was a month ago. All in all, Japanese data and political development will continue to demand close monitoring while Fed hike expectations likely remain the main driver of USDJPY in the weeks ahead especially given important US events, including FOMC, GDP, core PCE deflator, and nonfarm payrolls.

CAD: On the brink of recession

Despite the better-than-expected retail sales print in May (1.0% m/m vs. consensus 0.6%), we believe that the ongoing decline in the price of oil and other commodities and the weakness in investment will continue to weigh on the performance of the Canadian economy and hurt the loonie. After the recent cut in the BoC’s reference rate, the market will be following economic data to assess the possibility and timing of further easing. In that respect, the release of May’s monthly GDP next week will be the focus of the market (consensus 0.0% m/m) and will allow for a better assessment of the current state of the economy. A disappointing GDP reading would most likely bring Canada into technical recession (after a first-quarter GDP decline of 0.6%), putting pressure on BoC to commit to further easing. On the other hand, a GDP reading closer to BoC’s projections would give the central bank some room to wait. Particular attention will be paid to non-resource exports and consumer spending, which the BoC hopes will help cushion the negative effects associated with the decline of Canada’s terms of trade.

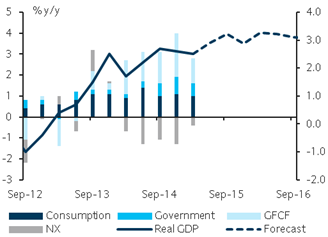

SEK: Activity data to test recent SEK weakness

Activity and confidence data releases in the coming week are expected to steer the path for the SEK, likely confirming a positive economic outlook. Solid retail sales (Tuesday) and the preliminary release of Q2 GDP (Thursday) should help unwind some of the recent currency weakness following the surprise Riksbank cut, which has driven EURSEK close to the top end of its recent multi-month range, contrary to our expectations. Moreover, the release of the Economic Tendency Report (Wednesday) will provide further insights into the country’s economic outlook and we expect the ETS Index to resume its uptrend. In line with the market (2.6% y/y) and the Riksbank’s (2.8% y/y) expectations, we expect a solid rebound in Q2 economic activity (Figure 3) despite the recent weaker-than-expected data reflected in our DSI (Figure 4). We think the trend of weaker data is likely to only prove temporary. Further ahead, we continue to expect a modest pick-up in inflation and further improvements in the Swedish labour market, likely allowing the Riksbank to tolerate moderate currency strength. We remain short EURSEK on the basis of the superior growth prospects in Sweden, a very undervalued SEK and our expectations that the Riksbank is close to the bottom of its easing cycle and see the recent uptick in EURSEK as an opportunity to re-engage in short positions (see SEK: Inflection point, 12 June 2015).

| Figure 3: Growth expected to remain solid | Figure 4: Recent data weakness likely to be temporary | |

|

|

|

| Source: Riksbank, Haver Analytics, Barclays Research | Source: Bloomberg, Barclays Research |

NJA and AUD: USD-Asia crosses moving higher across the board

USD-Asia crosses have pushed higher over the past two weeks after Fed Chairman Yellen signaled that the FOMC is likely to raise rates later this year. USDKRW, USDSGD and USDTHB have led the move higher in region, and now the previously lagging currency pairs like USDTWD, USDIDR and USDMYR have started to move out of their consolidation ranges of the past one month. We expect the strong USD trend to persist, especially with the lack of a convincing turn in economic activity in Asia. Korea’s Q2 GDP print surprised to the downside last week, and this week’s July exports print for Korea (Saturday 1 August) is likely to worsen to -7.5%y/y from -1.8% previously, adding to negative sentiments to the KRW. Korea’s June IP (Friday) is also likely to remain in contraction on a y/y basis (Barclays: -0.5%; last: -2.8%). In Taiwan, we expect Q2 GDP (Friday) to slow to 3.0%y/y from 3.4% in Q1, given weak exports and IP of late. Thailand’s manufacturing output and exports for June (Monday) are likely to show negative prints (y/y basis), weighed by poor demand from China. We expect China’s Official PMI for July (Saturday) to edge up to 50.4 from 50.2 with some signs of improved trade momentum, but the unexpected drop in the Markit ‘flash’ PMI raises the risk of disappointment which would add further pressures on commodity currencies like the AUD. That said, technicals show currency pairs like USDKRW and USDTHB are currently in short-term overbought territory, and thus a temporary pullback may be possible even if macro data continues to disappoint. However, we think that the USD would stay strong over the course of H2.

LatAm: No reasons for Banxico to have a hawkish bias; BCB to deliver 50bp hike

Mexican inflation at new all-time lows should weigh on Banxico’s decision next week. Despite recent weakness in EM currencies, we find little evidence of a broad FX pass-through and think that Banxico has enough arguments to soften its language. Economic growth below potential and a subdued optimism around reforms coupled with well-anchored inflation expectations will likely keep Banxico in check in the next few months. Any decision to hike in the months ahead will be strictly dependent on the Fed’s action and MXN developments. In addition, we believe that Brazil’s developments and China’s growth concerns will continue exerting some pressure in the MXN. We remain confident that USDMXN will continue its upward trend towards out forecast of 16.50, but we acknowledge the risks of a pullback in the short-term given how stretched the positioning is. 15.90-16.00 should serve as a good entry point to re-establish/add long USDMXN positions.

In Brazil, despite very weak economic data in the past few weeks, we believe the BCB will hike the Selic rate by 50bo in its next meeting (in line with consensus). After last week’s adjustment in the primary surplus and recent inflation developments, we think that Copom models will continue showing that more tightening will be necessary in order to move inflation to the midpoint of the target in 2016 and to strengthen the process of anchoring inflation expectations. While this keeps monetary conditions tight, fiscal imbalances continue to deteriorate in an environment of a very weak economy and subdued global economic growth. This should weigh on Brazilian assets risk premia, exerting additional pressure to the BRL as a credit rating cut looks more likely.

EMEA: CBR, BoI and CBT to decide policy

In Russia, we and consensus expect the Bank of Russia (CBR) to slow the pace of easing and lower its policy rate by 50bp to 11% on Friday MPC meeting. At the most recent meeting, the CBR signaled that it will slow the rate of cuts in upcoming meetings and did not rule out possibly remaining on hold depending on the data. We think the CBR has reasons to continue cutting. While inflation remains high it is likely to experience a marked decline towards 7.5% by mid-2016. Meanwhile, the growth trajectory remains depressing as June real sector data confirm the recession. In addition, the recent decline in oil may give some incentive for RUB weakness to partially offset the unfavourable impact on fiscal balance.

In Israel, Bank of Israel (BoI) is widely expected to remain on hold at 0.10% next week. Inflation has started to increase, and the BoI forecasts that it will move up to the centre of the target by mid-2016. However, ILS appreciation remains unwelcome given the underperformance in exports, and recently caused the BoI to considerably increase its FX intervention. We reiterate our long USDILS recommendation ahead of the rates meeting.

In Turkey, CBT will publish its July quarterly inflation report next week. It will be important to see whether CBT will have any revisions in inflation forecasts on the back of recent TRY weakness; and provide any insights on potential simplification of monetary policy in the coming months, which seem to be expected by the local market participants.