ECB QE start nears: will the Markets copy the post-Fed-QE move? Policy divergence expectations gone too far. China easing – the icing on the cake.

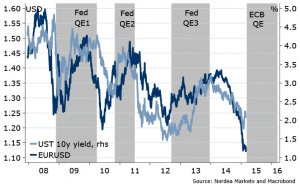

Finally, we should find out when the ECB actually starts the QE – some time by mid-March. The EURUSD and the long rates didn’t take off on ECB TLTROs, and barely stabilized on the QE announcement. It remains to be seen whether the actual start of the QE will do the same Fed’s QE did: RISK ON. Bunda Bunda.

Figure 1. Last test – by mid March

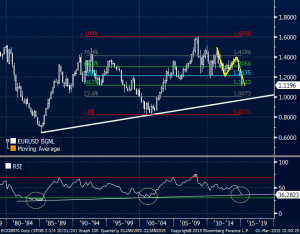

Why this is important now? The EURUSD is testing the 1.12 again, a very important level from the long term perspective, as flagged before. Below we should say hello to 1.1098 (YTD lows), and if that doesn’t hold, parity becomes a sane call. Not before.

Figure 2. Testing 1.12 again

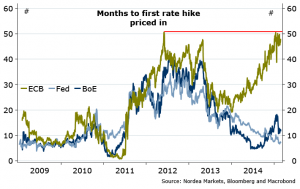

Policy “convergence”? Against the “divergence” theme, which happened 2014, and was extrapolated by many for 2015. To my mind, the pricing in the Markets ihas gone too extreme – the ECB expected to hike in 48 (forty eight!) months, which is exactly what they were priced to do back in the heat of the Greek crisis in 2012 (Figure 3). Things are much better now, as seen from previous weeks’ stronger euro area credit, money, consumer confidence, PMIs, even inflation data… Draghi should squeeze out a smile in this week’s ECB meeting (taking credit for QE before it even starts? 😉 ).

Figure 3. Mind the gap

Yes, the Fed is ready to hike rates, probably earlier than the majority expect (June…April?), as judged from previous week’s Yellen’s testimony, Fed speeches, core/trimmed inflation data. This week’s highlight is payrolls, and while the headline figures are important, the Fed would probably rather focus on real wage growth, aggregate earnings growth instead of just the average hourly earnings we get as a flash, and the composition (some hints in Fed’s new paper on Yellen’s key theme, the pent-up wage deflation).

Figure 4. Wrong focus?

It is not happening for the GBP just yet, as EURGBP broke through that 0.7300 channel support last week. Politics? What politics?! “One thing at a time” – that’s the Markets. Maybe the EURGBP has to undershoot to 0.70-0.71 to find a meaningful support – maybe. But with the current more “fair” BoE pricing, ahead of this Friday’s BoE inflation expectation survey (more important than Thursday’s BoE meeting!), and the May 7th election risks, I would rather build GBP short positions vs European counterparts than long.

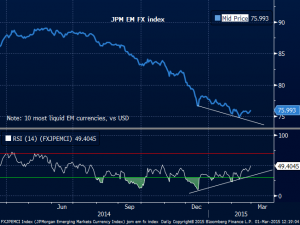

Carry on, Emerging Markets and commodity FX. ECB starting QE and China unexpected rate cut this weekend, with potential further easing, is the icing on the global recovery cake. This week we get the BoC and the RBA rate decisions. A cut from the RBA is expected (50/50), and more than 52bp of cuts in total priced for RBA within a year. But, remember, last month AUD was not bothered by a cut, neither by Steven’s comments on valuation. Why should it, this time? With the domestic data – labour, credit, housing…- improving, and everyone easing around… meh. Ditto the CAD: time for a breather, as the BoC is to stay on hold. The USD or JPY funded.

Figure 5. Emerging Markets FX – slooow turnaround

Nordea