The EUR got stuck despite better data, and Greece is only part of the story. Fed hike threat in disinflation is USD-positive – will Yellen hint change this week?

It has surprised me that the positive economic surprises from Europe, strong retail sales, solid PMI data, finally positive growth revisions…against softer US date, have not helped the EURUSD much.

Figure 1. Hmmm…

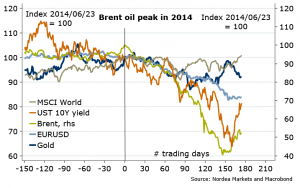

Figure 2. What are we waiting for?

Also, consistency check across Markets: stocks went up, US Treasury yields went up, oil prices went up…but the EURUSD is stubbornly stuck. Why so? I find 3 explanations:

- Greece. Headlines and fear of the upcoming Grexit was last week’s yo-yo factor. It seems this risk is off for (4 months), now following Friday’s agreement. No, it’s not over yet. But looking at contagion in Markets so far, comments from rating agencies, etc., I do not think Grexit is the big threat as it used to be in 2012. Actually, it could even benefit the EUR, not least since it may cause further…

- Deleveraging. Credit data improving – good news for the euro zone! But not good enough for EUR – actually bad – if you think about Japan as an example: deleveraging was big tailwind for the JPY for years, and end of has happened with massive JPY weakness. Maybe end of deleveraging is bad for EUR too? At least for some time, until we see…

- Inflation! I feel there is a broad-based lack of hope the oil prices will continue rise. Also, note, the price of gold, which is perceived as inflation hedge, has fallen back again (Figure 2). Global disinflation has always been good for the USD, and unfortunately we don’t see inflation up yet (wait for H2 – base effects). Even the US headline inflation, reported this week, will likely turn negative. Deflation in the USA! And what will Fed’s Yellen say?

“Mehhhh”. Her Testimony on Tuesday is this coming week’s highlight. From previous week’s Fed speeches (e.g. Mester saying June is a “viable option”), the FOMC minutes, it seems there is urgency to hike sooner rather than later. I looked (for the fun of it!) at Greenspan’s Testimony in February back in 2004, before the June rate hike. A few things that look better now: corporate lending, payrolls; worse: mortgage lending, productivity growth. Different (bad or good?): inflation – now lower.

If history is any guide,With all the data so far and Fed’s take on oil price fall, I do agree with our economists’ view that hike is likely to come sooner rather than later (market priced for September).

The UK is a similar story to the US, and now the first hike is priced more “fair” relative to history, 4 months after Fed. Last week’s labour market data was solid, justifying a BoE hike end this year. But I start seeing a few clouds around the UK ahead of the May 7th election, which may help the EURGBP hold above this long term support just above 0.7300.

Figure 3. Heads up

As for the rest, I am happy to see the AUDUSD grinding up (trade of the year). China’s flash PMI on Wednesday is a risk, but a sub-50 reading is a consensus already: how low can it go? There are some signs of stabilization in base metals prices, which, I think, still need oil prices to rise a bit more for confirmation. Just a little bit.

Figure 4. Both will turn together

Nordea