Liquidity should improve with more signs of improving household consumption globally – hence better prospects for less liquid currencies…

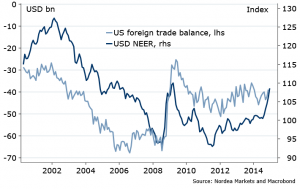

Liquidity is a hot topic these days, and one thing people miss is that’s it not about the supply – rate cuts, QE – but also about the demandfor money. Private money. So far there has been lack of, notably in the US, the country of world’s ultimate consumer, funding and reserve currency: e.g. mortgage market has been stagnant, the US current account deficit has narrowed… hence the recent USD strength.

Figure 1. Fewer private USDs ‘exported’ = broad USD strength

There are some signs of change, however.

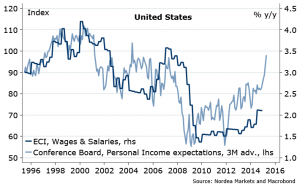

“International developments” worry from the Fed last week – uneasiness with the recent USD rise. True, the earnings of the major US exporters reported last week raise the eyebrows; exports WILL be under pressure in coming months; ISM, reported this Monday, will likely show a fall by more than a point. But. For recovery, rebalancing and liquidity, consumer matters most – and recent consumer confidence figures have been off the charts. The ECI wage data on Friday was ok, and what we want to see next is improvement, potentially upward revisions, of the hourly earnings data, maybe even in this coming Friday’s payrolls report.

Figure 2. Consumer is always right…right?

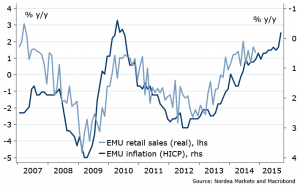

In Europe, previous few weeks’ ECB data showed we have a decent chance of credit picking up. Finally. Demand for credit? It comes from the household consumption, more than half of any major economy. That moment when you realize that indeed, Draghi was right – with low inflation you DO buy more stuff. And then more. Even in Spain, where retail sales growth is now back to 2005-2007 rates. This week’s figure, reportedly “Tier 2”, is the European retail sales. Brace yourselves for more good news ahead…

Figure 3. European consumer is back

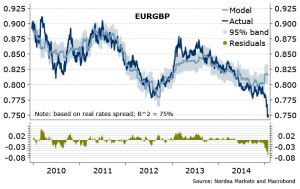

The BoE on hold this week. They should trace Fed with a hike by a quarter or two, if history is a guide, and that’s how the Market is priced now: Fed to hike in October this year, the BoE toward mid-2016. Rather consistently. Labour market and retail sales – similar positive trends shared. So now the GBPUSD is stuck, the EURGBP has some tailwinds (the EUR side is just done done…overdone).

Figure 4. Still waiting…

Will the BoJ be the first bank to acknowledge that too much of a good thing (read = currency weakness) is bad? It seems like government is getting uncomfortable. Finally listen to households? The JPY strength short term likely for other reasons too, as written in my monthly note in mid January…but still expect eventually more weakness in months ahead, should domestic consumption keep recovering and global picture improves.

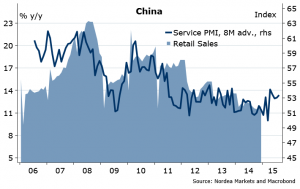

China’s local PMIs on Sunday disappointed, and yet still decent domestic demand picture, and the Markit data should confirm on Tuesday. AUD cares. The 50% chance for the RBA to cut rate by 25bps this week, and a total of 60bps cuts within a year – I would lean against, seeing the recent data from Aussieland. RBA’s Stevens said he wanted AUDUSD closer to 0.75: well, he almost got it. I was too early to call a reversal in this year’s trades. But not giving up on it.

Figure 5. 2015 > 2014 for Chinese consumer

RUB et al… what a slap in the face last week! Well. At least we know the rating agencies are always late to the party with rating changes, hopefully so was the S&P was on Russia last week. And with the Brent oil jump on Friday, the USDRUB finally is… at its “fair”. Yay.

Figure 6. Equilibrium point

Nordea