ECB’s QE expectations are high…or too high? The PMIs, out this week, matter no less than ECB for the EUR prospects.

Nearly every note this week starts with the ECB QE, supposedly week’s, if not year’s “key event”. The SNB’s decision last Thursday sets the market expectations for a massive bazooka from Super Mario. Surprise? Or, “buy the rumour, sell the fact”?

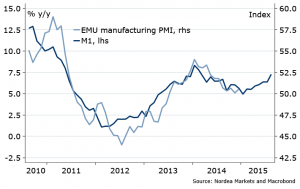

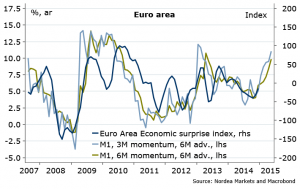

Many people think central banks drive the market trends, which, I claim, is not the case. They are just followers. Or, communicators of macro trends. Remember, the ECB shifted tone to dovish last year and the EUR fell off after the PMIs peaked, China’s housing market turned down, global growth prospects started to worsen and…oil prices fell out of bed. Now it seems the chances are for upside surprises. This week is a test – we have PMIs on Friday (Figure 1). And if it comes higher, this should not be the only positive surprise ahead (Figure 2).

Figure 1. Getting there…

Figure 2. It’s all about the money

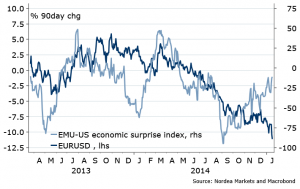

The economic surprises have helped explain the moves in markets over the past few years, including the renewed rise in European stocks relative to the US’ just recently, the rise in Germany 10Y yield vs US Treasury 10Y yield…and yet the EURUSD has not caught up yet. Will it?

Figure 3. So far…too far

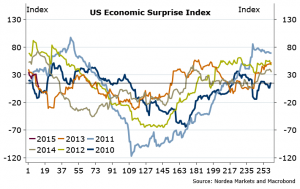

It takes two to tango. What about the US side? Oops. Some data was not as good as expected lately (Figure 4). Hereby the biggest surprise to me: seven years since Lehman… and we still have the same tendency for the US data to be improving in H2, and then surprising on the downside in H1 (Figure 5). This time is different? Meh…

Figure 4. US data surprises by sector – most down

Figure 5. Not. Again…

Nordea