Dark clouds have continued to mount for the Euro Area, putting pressure on the EUR. The overall macro story is conducive of further USD strength, but the near term is somewhat cloudy owing to the ECB.

EUR/USD reached our near-term forecast in the early days of January as dark clouds have continued to mount for the Euro Area. Plunging oil prices are intensifying the risks that inflation expectations will become unanchored. This increases the pressure on the ECB to deliver more easing, potentially already at the January meeting. ECB’s chief economist Praet recently said ‘…this risk is already materialising: companies are starting to adjust to a “1% growth/1% inflation economy”. Elsewhere, the Greek election, due January 25, has prompted some “Grexit” fears on the back of comments from Germany that the Euro Area could cope with an exit. Not all is doom and gloom however, gauging by monetary aggregates, Euro Area activity should stabilize and start to pick up gradually in coming months and quarters.

Across the Atlantic, there are few signs that the Fed is considering softening, even though inflation readings close to zero look likelier by the day owing to dropping energy prices. There’s also a distinct possibility that the (normally) important ISM manufacturing gauge will drop in coming months, hinting at decelerating growth in the US, but actually more reflective of seasonal adjustment distortions… The overall macro story both in terms of the economy and in terms of monetary policy is however still suggestive of USD strength

Near-term cloudy due to the ECB

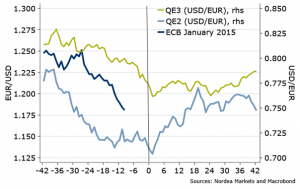

The 22 figure drop since the spring of 2014 does however warrant questions on how much is already in the price, especially in terms of ECB QE. Gauging by US experiences (chart 1), the currency whose central bank is about to launch a big QE program remains under pressure until the market obtains details of said program, after which the currency appreciates. Should the ECB launch a big-enough QE program – including details, at least on its size – in January, this could pave the way for weeks of EUR appreciation. In this scenario, the market will also need a new narrative to trade on. Should the ECB formally note its intent to launch a QE program, but delay in providing details, the market could keep chasing EUR/USD lower until the dust clears.

Real rates still likely to undermine the cross further

In the longer term, it is worth highlighting the relationship between the cross and relative activity (as proxied by PMI and ISM), as well as with relative real rates (chart 2). Relative activity suggests a rise in EUR/USD above 1.25 – owing to the drop in ISM and the stabilization of EMU PMI. This would make for a very interesting and contrarian forecast. However, the lessons from Sweden suggest “not so fast”. Since the Riksbank decided that inflation is what matters for monetary policy, activity has taken a back seat in affecting the exchange rate (chart 3). This should be the case for the Euro Area as well, at least until the ECB is much closer in getting inflation and inflation expectations back to target.

Indeed, while the relationship between EUR/USD and activity looks decent since 2008, the relationship between the cross and relative real rates is much stronger. According to the estimates provided by the ECB and the Federal Reserve in December, the EUR/USD consistent with the central bank’s outlook for real rates is 1.15 – again in line with our current forecast.

In short, we keep our current 3m forecast of 1.20 for now, but see further downside in the slightly longer run. The risks to our forecast are tilted to the downside.

What to watch

Developments which impact on Euro Area inflation expectations are likely to be crucial for the ECB, these could include rising commodity prices and also accelerating activity, domestic and global. But to be fair, with 2y2y inflation expectations below 0.7% – things will need to improve markedly before the ECB eases off the accelerator. As for the US, core inflation readings will be crucial for the market’s view of the Fed which “…might begin normalization at a time when core inflation was near current levels”. Should core inflation drop a few tenths from today’s levels (core PCE deflator 1.4% in November), the first rate hike could be postponed to late 2015 or even into 2016.

Key events ahead

- January 14 – ECJ’s Advocate General will publish his opinion on the legality of the ECB’s OMT programme

- January 22 – ECB monetary policy decision

- January 25 – Greece general election

- January 28 – FOMC meeting

- February 2 – US PCE deflator

- March 2 – US PCE deflator

- March 5 – ECB monetary policy decision

- March 18 – FOMC meeting

Chart 1: EUR/USD around important “QE” events

Chart 2: EUR/USD, real rates and relative activity

Chart 3: EUR/SEK and relative economic surprise indices

Nordea