Record-low yield levels were reached again yesterday on Euro-area government bond markets. The German 10-year yield slumped by another 3bp to end at 0.75%, the lowest closing level on record (the October intraday trough stands at around 0.72%). The 10-year EUR swap hit a new low of 0.94%. US yields fell by even more, with the 10-year yield retreating by 5bp to its lowest in almost a month. Curves bull-flattened.

Intra-Euro-area spreads continued to narrow, but the moves were rather small especially outside the semi-core.

The bond market momentum certainly looks strong at the moment, especially in Europe, and yields have clearly not reached the bottom yet. More gains for bonds are thus set to be in the cards today as well. In the US, the looming Thanksgiving Day holiday should keep bonds supported.

European equities were able to squeeze some more gains, and the Stoxx 600 ended the day up by 0.16%. In the US, S&P 500 took a modest loss of 0.12%. Asian markets are trading mixed this morning, and Europe is set to open close to flat.

Bundesbank worried about corporate bond bubbles

The German Bundesbank warned in its financial stability report that the search for yield was leading to exaggerations in certain market segments, especially in corporate bonds and syndicated loans. It is easy to find justification for such worries, when one looks at the yields or spreads these instruments are offering compared to the history, but many valuations look exceptional currently compared to history. This is what happens in a world of huge central bank stimulus measures, and the prices of these instruments are set to rise even further, as the ECB is preparing further expansions to its bond purchases. The Bundesbank is unlikely to back such expansions, and its worries over bond bubbles are set to grow further, but this is not going to prevent the ECB from taking further action.

Busy US data flow continuing

The flow of US economic data releases will continue today, as tomorrow’s Thanksgiving Day holiday means a lot of data will be released already today. The highlights in the US calendar include the October personal spending report and durable goods orders as well as weekly jobless claims at 14:30 CET, the Chicago PMI at 15:15 CET, final November University of Michigan consumer confidence at 15:55 CET and October new & pending home sales at 16:00 CET.

In Europe, European Commission President Juncker will present his investment plan to the European Parliament at 9:00 CET, while the ECB’s Constâncio will speak at 10:10 CET.

Supply action from Germany, Portugal and the US

Germany will re-open its 10-year benchmark for EUR 4bn today, while Portugal will offer exchanges from three bonds maturing in 2015 and 2016 into bonds maturing in 2021 and 2023. This week’s US benchmark auctions, in turn, will be concluded by the USD 29bn 7-year offering.

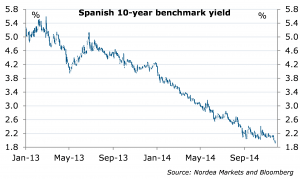

Spanish 10-year yield fallen below 2%

Nordea