Price action over the past few weeks suggests the EURUSD may rise more on short covering, GBP faces more downside against European counterparts, major commodity currencies to gain more vs USD short term.

There is a reason why I mentioned “reversal” in my previous Sunday’s note, and the developments over the week, including the price action on Friday, weekly close above 1.2505, suggests there is some more to go for the EURUSD short term.

Lower oil and food prices is good news for global economy, helping the consumption already: last week’s China’s strong retail sales growth, and more importantly US’ robust retail sales data, could be just the beginning of positive global consumption momentum in coming quarters. This, I have argued before, likely suggests a re-widening of the US current account balance, one significant trend which incidentally was a negative for the USD historically.

Figure 1. Stronger consumption – stronger imports?

How little it takes from Europe to surprise positively, you can observe – last week’s GDP “beat” being no exception. The EMU-US relative ESI continues creeping higher. Despite ECB action, the EUR money market rates are off above post-September ECB meeting lows and the 2y EUR-USD nominal swap rate is above the September lows too, thus not confirming the EURUSD lows in November. Mind you.

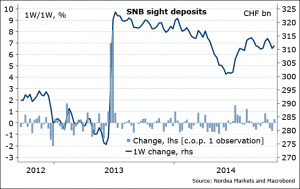

Is the Swiss vote on November 30th regarding SNB’s gold holdings a risk to EUR? Yes, it would put pressure on the EURCHF floor, which we have seen last week (the options market pricing 20% probability of EURCHF below 1.19 in 3M). But if “Yes” vote comes (highly unlikely, imho), those who risk positioning against the SNB will be likely rolled over by the SNB: a charge on CHF sight deposits, maybe even rate cut, to promite capital outflow. EURCHF toward 1.30. Period.

Figure 2. SNB not even intervening just yet

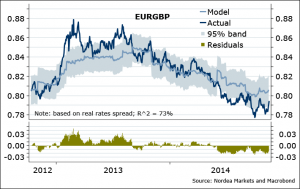

The BoE’s dovish Inflation report last week, and their key disappointment – the housing market! I have been warning about many times – too early, admittedly, but finally materializing. One significant detail from the BoE report is the importance of GBP (this week CPI will be reported): “the past appreciation of sterling… has subtracted around ¾ percentage point from CPI inflation over the past year” – implying, 10% strength knocks a full 1%pt off (ECB for EUR: 10% – 0.5%pt). Political risks are to put more pressure too, with election next May. Keep the EURGBP long, GBPSEK, GBPNOK short for now, still.

Figure 3. Still below “fair”

Some tension in Japan, as PM Abe is keen to postpone the next VAT tax hike (planned for October 2015), with talk of early elections to be called in December (unlikely). What would another VAT tax hike mean to JPY? Probably stronger. But that’s not here and now. Here and now the USDJPY looks stretched and could fall back toward 114. But if my call on risk sentiment, rates is right for the rest of the year, the JPY will be “sell on strength” going forward, especially against…

Commodity currencies. Won’t change my opinion here: end of year, global economic picture (relative to consensus perception), positive divergences, and significant supports, in particular against the USD, so hold AUD, NZD, CAD, NOK long tactically. My gut feeling tells we are going higher for the rest of the year as volatility is to remain low. “Carry”, if you will.

Nordea