Despite the recent market turmoil, we expect the Fed to end its QE programme at this week’s FOMC meeting, which concludes on Wednesday. However, we expect the Fed to make it clear that there are no plans for tightening yet. A more direct acknowledgement of downside risks posed by global factors is likely. Treasuries look set to record modest gains after the Fed’s statement, while the curve could flatten a bit. Dollar bulls should not worry much either.

Although St. Louis Fed President Bullard recently said that the Fed should consider continuing the programme because US inflation expectations are falling, we believe the Fed will complete its asset purchases with a USD 15bn reduction in the pace of purchases, ten months after it began the tapering process.

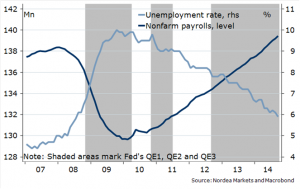

When the current programme (QE3) was launched in September 2012, the Fed said it would keep buying assets until there was a “substantial improvement” in the outlook for the labour market. As the unemployment rate has declined from 8.1% to 5.9% since then, we believe the Fed is ready to conclude that the criteria for substantial improvement have been met, as also Boston Fed President Rosengren said recently. As a matter of fact, the unemployment rate is now below the levels seen just prior to the start of QE1 back in late 2008 (see chart).

Overall, the latest communications from Fed officials indicate that the central bank remains focused on real economic data. Thus, the bar for financial market turmoil to move monetary policy seems relatively high, particularly because the economic outlook hasn’t materially changed.

While we believe it is rather likely that the Fed ends QE now, we are much less certain whether it will remove from its post-meeting statement the key phrase that rates will stay low for “a considerable time” after the end of QE. In fact, we see it as a close to

Our base case is that the phrase will be removed and replaced with forward guidance that is more data dependent. The reason is that several Fed officials are uncomfortable with the phrase, given that it is often perceived as pegged to a calendar reference and not to the economy’s progress.

However, we do acknowledge that the phrase might be left in this week’s statement due to the current weak market sentiment and because there is no press conference after the meeting.

In any case, we expect the Fed to make it clear that there are no plans for tightening yet. Thus, an acknowledgement of increased downside risks to the US growth outlook posed by global factors seems likely in the FOMC statement. Also a bit more concern about downside risks to inflation might be added to the statement.

We expect again to see hawkish dissents from Dallas’ Fisher and Philadelphia’s Plosser.

Substantial labour market improvements

Bond bulls should not worry

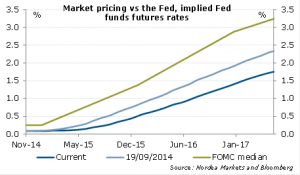

As discussed above, the Fed will be careful not to send any new hawkish signals at this point, especially after the recent market turmoil and the fall in inflation expectations, as there is no chance to explain new language in detail (no press conference). As a result, Treasuries look set to record modest gains after the Fed’s statement, while the curve could flatten a bit. However, the fact that the market is already pricing both a later start and a slower pace of tightening compared to the FOMC median should limit the size of the moves.

Markets already pricing in clearly less tightening than implied by the FOMC

Dollar bulls should not worry much either

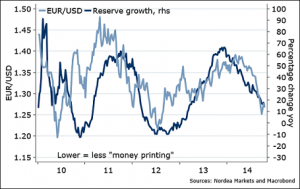

While being long the dollar is a fairly crowded trade, recent speculations that the Fed will cancel or delay its final 15bn taper will be dashed on Wednesday. This should imply a slight bid for the dollar despite the Fed sending a fairly dovish message – monetary regime shifts do matter. The slight bid we expect for Treasuries is thus unlikely to negatively affect the USD.

EUR/USD: speculations of no taper/QE4 to be dashed

Nordea