With the European bank stress test results out, the banks, if anything, have one minor reason less not to increase lending. End of deleveraging is good news for the euro area economy, but… EUR?

There has been many stories about the EUR doomed as the euro area becomes the next Japan, when in fact deleveraging has been the driving force for EUR strengthening until this year. And what happened this year? Deleveraging has paused.

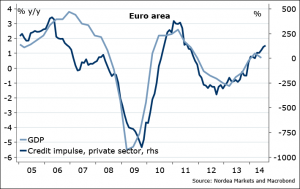

Figure 1. Are we there yet?

The pause in deleveraging is seen in various data: net demand for private debt is rising, even corporate net demand turned positive this year, credit impulse is positive, bank credit standards easiest since 2006-2007 levels, and European banks have started to grow assets abroad. Plus, the ECB targeted measures should help boost lending. Good news? For the euro area economy – yes. For EUR – no. O not yet.

Figure 2. Pent-up demand

Figure 3. Positive impulse

Figure 4. Increasing external assets

Another way to look at deleveraging theme is to look at the balance of payments. The euro area has begun to run current account surpluses after the crisis – that is, it has become net saver toward the rest of the word, or net lender. I am surprised to often hear that, what was used to explain the EURUSD strength from mid-2012, is now used to forecast its weakness. That is, increasing financial outflow will weaken the EUR, they say.

Well.

Figure 5. Two sides of the coin

The balance of payments is always balanced – that is, surplus on one side, deficit on the other side. So if financial account deficit were to widen, then the current account surplus will widen too! And most major economies I have observed, it is the current account balance, more stable, correlates positively with the currency value, not the financial account. For example, the US has has been running surplus on financial account for many years – did it help strengthen the USD? No, it hasn’t. Rather, the current account deficit drove it weaker.

Figure 6. Financial inflow…so what?

Or, have a look at Japan’s history. The positive current account surplus for years didn’t make JPY weaker. It made it stronger! Yes, Japan was too, just as the euro area now, seeing outflows from the financial account over many years, as the other side of the strong current account, but the financial outflows didn’t. make. it. weaker. More than that, running those current account surpluses Japan has accumulated USD 3.7 trillion in claims on foreigners, thereby becoming a “safe haven” currency, as repatriation of those claims, in volatile times, strikes back. big time. Only in the recent few years Japan’s current account balance turned negative, thus helping JPY weaken significantly – but it will take years to reduce its accumulated claims onto the rest of the world.

Figure 7. Current account surplus kept JPY stronger for years

Now let’s look at what happened in the euro area this year. Actually, the current account surplus stopped increasing – another sign of pause (end?) to deleveraging. This is exactly one reason why the EUR strengthening got reversed.

Figure 8. Surplus stopped rising

So, yes, pause, or end of deleveraging is hurting euro, even though it’s good news for the euro area economy. But one can argue, if the worsening of the current account continues, and lending picks up, this will be for good reason – demand coming back to the, oh-so-Japan-like Europe! This should force ECB out of easing mode at some point next year, shouldn’t it?

Nordea