GBP to weaken further, with Scottish indepdence – yet another risk; Draghi’s soft currency guidance keeps EUR under pressure, but now that EUR rates are at lows, the EURUSD will increasingly depend on the USD side…

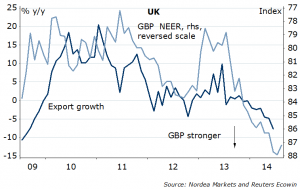

Yes, they can, leave the UK, it turns out. With the odds for Scotland to break free improving, the chances of GBP underperforming are increasing too. Accounting will be against it – risks of UK debt/GDP rising above 100%/GDP; worse yet, the current account deficit expanding from the currently worst in G10, to a gap in excess of 7%/GDP…a weaker GBP would be more than welcome.

Figure 1. Strong GBP weighing on exports

I won’t go much into detail, just say that a “yes” vote if it comes next weekend will mean months, if not years of uncertainty about sharing the fiscal burden, elections, EU exit…and uncertainty is exactly GBP’s key risk now: with the given positioning (GBP longs vs extreme shorts in EUR), any further rise in FX volatility is to EURGBP support.

In a bigger picture, if we get a new Scottish currency…the Pandora Box is open: chances of getting more currencies, including in the euro are, rise. Good for volatility. Good for European banks. Good for FX strategists. Sort of.

Looking through the of inconsistencies of ECB action last week (at least 3), the base rate is as low as it can get, and the September 18th first TLTRO, followed by October 2nd ECB meeting, beginning of European ‘QE’, will allow to test my ‘buy on rumour sell on fact” thesis, which worked well for Fed’s QE. (More central bank money -> more risk taking -> cheaper risk-free bonds -> weaker USD)

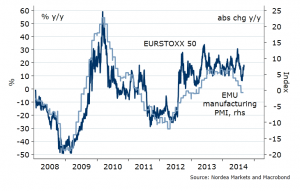

FIgure 2. Need. More. Money.

Survey data Draghi’s guidepost, it is clear from last week’s ECB meeting. What he used to justify EUR strengh earlier this he now uses to push its weakness (currency guiding). Thus key question is whether the recent decline in European manufacturing PMIs is a temporary blip, notably deviation from the US’ cannot persist. But PMIs will largely depend on stock market performance, in particular, the hope that ECB action and AQR will help banks (and their equity prices), and so will the EUR. Circular reference #error.

Figure 3. Real time euro area PMI

US payrolls report last Friday was largely a disappointment. Wages stuck at 2% y/y, 3 years and counting. And the drop in headline number surely raises Yellen’s eyebrows, who in her Testimony just a few months back expressed fear that this is yet another “false start”: 6-9 months of strong payrolls, and…boom. A hole. But one point is not a trend, right?

Still. Since we got used to strong US data, further repricing of the US Fed funds up, may pause, at least until, but likely also through the Fed September 17th meeting, thus reversing some of the USD rally. The multi-year trend for EURUSD around 1.28-1.30, that’s where the previous major lows lie – a tough nut, unlikely to be cracked by only second tier data this coming week. Even the US retail sales on Friday. Expectedly strong.

Figure 4. Relative macro surprise spread at historic lows

Nordea