US front-end yields remained firm on Tuesday, despite a modest setback for equities as new US sanctions on Russia were announced, notes BNP Paribas.

“Today, the ADP report is expected to show a 230k increase in private payrolls, consistent with expectations for Friday’s official employment report to show a sixth consecutive reading above 200k, even though ADP has tended to run weaker than NFP in recent months. GDP will tell a weaker story, with our economists anticipating a below-consensus 2.5% (saar) rebound in Q2 from the 2.9% contraction reported in Q1. However, markets are more focused on more timely indicators now and have moved past the soft pace of activity in H1 already given the rapid improvement in labour market indicators,” BNP projects.

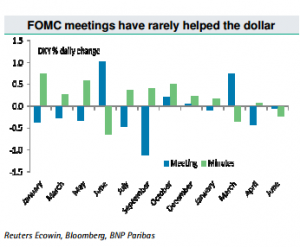

“Later in the day, the Fed is unlikely to alter the dovish message of its last policy statement, and there is no press conference or forecast updates released. However, to the extent there are subtle changes, they are likely to be in the direction of highlighting improvement in the labour market or reduced disinflation risks, and even a slight hawkish drift could reinforce the upward pressure on front-end rates,” BNP adds.

In line with this view, BNP remains constructive on the USD, maintaining short EUR/USD and long USD/JPY in its portfolio.