Against our expectations outlined last in last Friday’s Weekly, EUR/USD has not traded sideways ahead of this week’s US non-farm payrolls but rather been pulled to fresh lows.

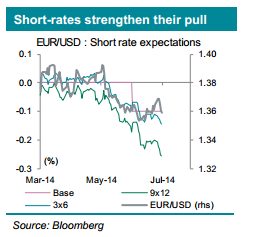

Providing this gravitational pull, short-term interest rate spreads have moved further against EUR/USD with even Q4 2014 tenors touching new lows in the past 24 hours. That this EUR/USD sell-off has barely paused this week, not even waiting for tomorrow’s Fed statement (i.e. let alone NFP) is a warning that markets may be getting too far ahead of themselves.

Moreover, the somewhat nonchalant stance of equity markets – still indifferent to the rising (but still low) cost of USD-funding – suggests investors (as yet) either do not foresee an abrupt change in Fed policy stance. This somewhat apathetic equity stance argues latest moves FX and rates are likely overdone – at least within the time frame by which QE will terminate!

Therefore while we remain short EUR/USD targeting 1.33 in our strategic portfolio, from both an event-timing and cross-market evidence perspective, we warn against chasing this pair lower predicting a bounce higher to more attractive levels at which to add short positions.

CA