The USD hovering at a major 1.5y support – break here should bring major new lows; European bad IP data, out this week, already “in the price”. Good luck fighting Draghi.

Beating the dead horse – Portugal last week. Such “sell offs” in periphery are not a surprise, especially after such dramatic falls seen in the months before. Remember, even in the old abnormal, peripheral yields widened sometimes – yes, they did. But guess what, now we also have Draghi’s “whatever it takes”. So please, move on.

Figure 1. Just saying…

What has been a drag on EURUSD recently is the relative macro data – softer PMIs and industrial production reported over the past few weeks (too much holiday in May), which will result in a larger than 1% m/m fall in overall euro area’s IP, out this week. But this no longer is news, thus should not affect the EUR any more. Keep the EURUSD long against 1.3490.

Figure 2. Not Draghi – data

Key speculation this week: what will Yellen say in the semiannual testimony on Tuesday? The closest references we have are most recent Fed speeches, including Yellen’s, and the FOMC minutes from last week. Yellen won’t throw a bomb in the middle of the summer, ok? She just won’t. And she will not be talking her view, but those of the FOMC, so balanced. The latest FOMC minutes (from June 17-18 meeting) do suggest a cautious Fed, despite improvements in labor market:

- “Both the share of workers employed part time for economic reasons and the rate of long-duration unemployment edged down in recent months, although both measures were still high.”

- “Increases in measures of labor compensation remained modest…Over the year ending in May, average hourly earnings for all employees increased around 2 percent.”

- “…the risks to the forecast for real GDP growth were viewed as tilted a little to the downside, as neither monetary policy nor fiscal policy was seen as being well positioned to help the economy withstand adverse shocks.”

Glass half full. The USD index (DJ) is close to a critical support level (descending triangle from early 2013), below which a major dollar fall would happen. China’s Q2 GDP is out this week, expected to recover to 7.4% from below 6% annual rate in Q1. Not least due to stimulus, money market and CNY, monthly data has been improving; the June data should be a continuation of this trend. Keep long AUDUSD for now.

Real wage growth is what matter’s for UK’s economy: we get both data components this week. Remember, previous consumer price and wage inflation prints disappointed; one more miss would postpone rate hikes (currently first full hike early 2015 priced in). Will the BoE indeed be the first to hike, or first to disappoint? The GBP long positions remain stretched, bias to sell GBP vs EUR…but may be still a month or so too early, as difficult to see volatility exploding here. It just never does before it does.

Figure 3. Inflation – BoE’s confirmation

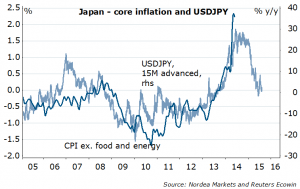

The BoJ will stay put this week. The recent data has been a rollercoaster, with May data not showing as much post April tax hike improvement as wanted. But the BoJ thinks the economy is about to close the output gap (soonest among G4), thus next few months will be a great test: will inflation fall off, as past JPY weakness wears off, or will BoJ turn out to be right (and everyone is wrong), inflation indeed is to be on the sustained uptrend? First scenario equals disappointment in Abenomics (stocks fall), second – surprise to the Markets (rates, volatility rise). Both speak for stronger JPY, not a weaker one. Sorry.

Nordea