Prepare for a summer where volatility falls further and carry performs, argues Deutsche Bank. After this week’s FOMC meeting failed to deliver any surprises, he noted risk premia were still well within historical averages, leaving plenty of room for further drops in implied volatility.

A consequence is that EUR/USD may drift back in line with real yields (fair value of 1.37). Indeed, the lack of concern Chairman Yellen displayed over inflation could lead to higher US breakevens which should undermine US real yields. Alan Ruskin noted, however, that Yellen acknowledged the threat of market complacency at the press conference, just as the Fed’s stress indicator hit another record low this week.

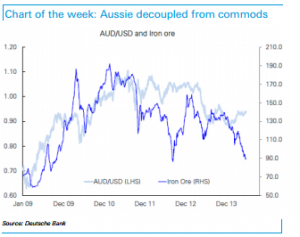

The FOMC median projection of the long term cash rate was revised down from 4% to 3.75%, which should be a positive for the Australian dollar. According to Adam Boyton, AUD/USD’s correlation to the 10 year US treasury yield has gone up markedly since mid-2012 after the market started anticipating the RBA would keep rates stable around 2.5% for the indefinite future. The dislocation between AUD and iron ore prices can thus be at least partly explained by the rally in US treasuries.

However, Boyton ultimately anticipated the relationship with commodities would reassert itself, leading to a lower aussie.

What next? Summer catalysts are hard to find but one could be higher US inflation pushing the Fed into a more hawkish stance earlier than anticipated. Geopolitical disruptions might also come from left field, so the Iraq crisis should be watched carefully.