The euro weakened in May following numerous ECB Council members’ comments that made it explicitly clear that additional monetary easing would be taken at the next meeting on 5th June. We expect the ECB to lower all its key official interest rates by 15bps, resulting in a negative deposit rate. Other steps are also likely. There have been explicit comments made in regard to a “targeted LTRO”, which may run along the lines of the Funding for Lending Scheme in the UK. In order to counter any adverse effect on lending stemming from a negative deposit rate, the ECB may feel justified in announcing some targeted lending program in order to support improving credit flows to SMEs. We do not expect QE to be announced although an explicit commitment to launch QE if downside inflation risks increase could be forthcoming.

However, a large part of what will be announced on 5th June is already priced in the market. If a number of measures are announced along with the rate cuts and a commitment to embark on QE if required, the euro is likely to weaken further. However, our EUR/USD forecasts are based not just on ECB easing but also on US economic recovery and higher yields in the US.

One reason for our caution is the fact that ECB monetary easing may well support asset prices in the euro-zone. Foreign investors have bought EUR 152bn worth of euro-zone bonds in the six months to February along with EUR 103bn worth of equities while the euro-zone recorded a current account surplus of EUR 124bn over the same period. We expect the scale of portfolio inflows to diminish as valuations start to look increasingly stretched. In particular, sovereign periphery spreads have returned to levels not seen since 2010, and further gains will be far more difficult to sustain.

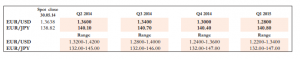

Assuming ECB action is forthcoming and includes more than just interest rate cuts and also assuming that the US economy strengthens through the remainder of the year, we expect EUR/USD to slowly grind lower. Our Q1-2015 EUR/ USD forecast remains 1.2800.

Bank of Tokyo-Mitsubishi UFJ