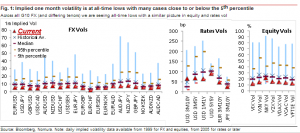

The macro environment over the past three to four months has been characterised by a decline in realised and implied volatility to very low levels across a range of products (from FX to equity volatility).

It is “normal” for volatility to be low in the expansionary part of the business cycle. But it is unusual for volatility to be low during a period of central bank easing.

We would argue that “not all types of central bank easing are created equal”. Interest rate cuts have often occurred during period of sharp economic deterioration and high macro and markets volatility. Quantitative easing, on the other hand, has often been employed in periods of persistently low inflation, but otherwise more stable environments…

…A change in the volatility regime and higher volatility could come from several sources: 1) a turn in the cycle (into downturn/recession), 2) removal of global liquidity, 3) build-up of financial leverage, 4) an unexpected macro or geopolitical shock.

Our macro and central bank forecasts do not project that a downturn/recession is around the corner or that global liquidity is about to be significantly reduced (although the ECB stance is more of an unknown factor). Meanwhile, our broad assessment on leverage does not point to broad-based excesses at this juncture.

Our overall conclusions are: 1) tactically, volatility levels in FX may have become over-extended to the downside; and 2) strategically, a material regime shift in volatility may not be just around the corner, especially not if the ECB injects further liquidity in H2 2014.”