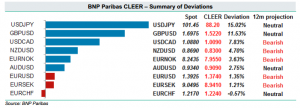

BNP Paribas today introduces a new forecasting model ‘CLEER’ which is a medium-term fair value model for currencies.

“CLEER stands for CycLical Equilibrium Exchange Rate and provides a fair value for G10 exchange rates based on the relative economic fundamentals of two economies. This approach captures how economic variables impact a currency throughout an economic cycle,” BNPP clarifies.

“BNP Paribas CLEER provides a gauge of where a currency should be trading based on cyclical economic fundamentals and provides model-based projections for exchange rates,” BNPP adds.

Here is how CLEER gauges EUR/USD, USD/JPY, GBP/USD, and AUD/USD

EUR/USD is trading in line with its current CLEER of 1.38…CLEER model projects EURUSD declining towards 1.34 over the coming year.

GBP/USD is trading above its current CLEER of 1.55 but the fair value is expected to rise over the next year as UK growth remains strong and rates increase.

USDJPY is trading above its CLEER of 88. This overvaluation is policy-driven by Abenomics.

AUDUSD is trading slightly above its CLEER of 0.91.