So, is EUR too strong, already? Well, unlike many things these days…

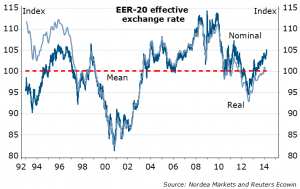

Figure 1. NOT A BUBBLE

Talking the talk… Yes, Draghi said that exchange rate is “significant” in their assessments for inflation last week, but so he did after the ECB meeting. From ECB’s Monthly Report, one can also read the currency effect on growth: a 3% permanent appreciation of effective EUR (with historic beta at 1.6, EURUSD around 1.45), would bring both growth and inflation lower by 0.1/0.2ppts in the forecast horizon. Not too much to worry about, is it?…In line with Draghi’s famous last words: “Any material risk of inflation expectations becoming unanchored will be countered with additional monetary policy measures.” Stay calm and keep holding EURUSD for a move toward 1.42.

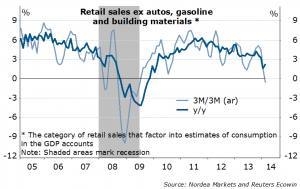

If EUR goes faster, stronger, much higher…one could, of course, imagine a coordinated intervention (remember Plaza Accord in mid 80s?), only if by talk, to weaken the EUR, but hey, who else wants a stronger currency these days? Definitely not Japan, surely not the UK. The most obvious candidate is the “historically cheap” USD…except that the US economy is not quiet flying there just yet: consumer data still a bit concerning, with last week’s retail sales and consumer confidence figures. And inflation still low: this week CPI could print closer to 1% y/y than the consensus expects. Bad for DXY if materializes.

Figure 2. Losing momentum…

Yellen’s chance to sway away from the hard unemployment rate threshold, to something softer and less tangible. Probably with references to under-employment, part-time employment, which she was grilled in her Testimony on. The FOMC meeting this week will be a forum to do that: acting along the lines of the Bank of England, which has switched from the quantitative to qualitative guidance. Admittedly, though, the camp of Fed doves has become less dovish lately – even Evans hinted that most of changes in the labour market are structural. Will optimism be justified? A few months needed to get the cold-weather-free data.

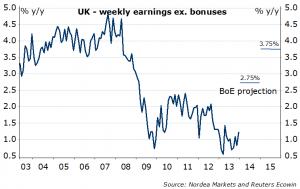

Speaking of the UK…the all-important employment report is out this week. Looks like the unemployment rate will again be 7.2%, but, as noted before, what the BoE is really after is productivity growth and wage growth. The latter, they have quiet an ambitious forecast for these coming years: we have seen an uptick from the 1% rate last year, but it is barely enough to live up to the expected rates yet. The GBP seems peak-ish broadly, though could still strengthen against USD short term, mostly on USD weakness (1.6600 key on the downside). Hold the EURGBP long from the second entry (0.8207) – has room to go to 0.8650, but first need to take 0.8450.

Figure 3. A high bar

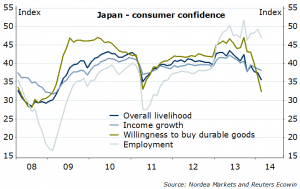

Japanese consumers not happy… because, logically, higher inflation means you buy less stuff! Not good news for the Japanese stocks, neither the USDJPY… More easing? So far the BoJ seems unbudged, judging from Kuroda’s et al. comments. Thus: it must get worse before it gets better. Holding the USDJPY short, we are going toward double digits, clearing the next support at 101.20 on the way.

Figure 4. Not in the buying mode

Nordea