Bonds started the new week with some gains yesterday. The German 10-year yield fell by some 3bp, while the drop in the corresponding US yield was a more modest bp. Intra-Euro-zone bond spreads saw some widening in the semi-core space, while Spanish and Italian bond spreads narrowed.

In the bigger picture, long yields have been moving largely sideways in the past month and a half, while the move in the past week has been upwards. With clear sources of uncertainty remaining, the near-term upside potential in bond yields should be limited.

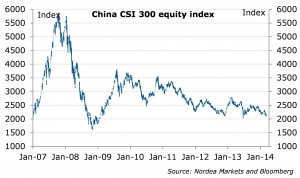

Equities felt modest pressure yesterday. S&P 500 ended the day lower by 0.05%, but the moderate retreat came from close to record-high levels. Still, US equities appear to be facing some resistance at current levels. Overnight, Asian equities are trading mostly with some gains this morning, but Chinese equities continue to struggle (the CSI 300 index is trading at close to 5-year lows) after yesterday’s credit data disappointed.

German banks win concessions in the ECB’s AQR

According to the Financial Times, German banks would not have to hand over details of their residential mortgage portfolios in the ECB’s asset quality review. German residential mortgages are unlikely to contain major hidden losses in any case, but if confirmed, the concessions illustrate once again the power Germany enjoys in shaping the European regulatory field. More information on the AQR is set to be released today.

Rather light calendar

Today’s data calendar looks rather light. US January industrial production numbers will be released at 10:30 CET, while the US NFIB small business optimism index will see daylight at 12:30 CET.

The EU finance ministers, in turn, will gather at 9:00 CET to discuss the Single Resolution Mechanism, while the Bank of England Governor Carney will speak at the Parliament’s Treasury Committee on the BoE’s inflation report at 10:30 CET.

Belgium announces a new 20Y bond –Dutch, German and US auctions on the agenda

Belgium announced yesterday it plans to issue a new 20-year EUR benchmark, with a maturity on 22 June 2034. The launch will take place in the near future, most likely today.

On the auction front, the Netherlands will re-open its 3-year benchmark for EUR 2.5 to 3.5bn. Germany will tap its 2018 inflation-linker for EUR 1bn. This week’s US benchmark auctions, in turn, will be set in motion by the USD 30bn 3-year note auction.

Chinese equities struggling big time

Nordea