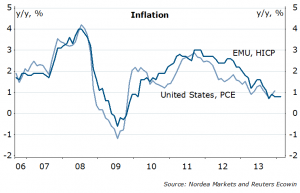

What we talk about, when we talk about deflation…it’s always and everywhere the euro area phenomenon, right? (Haters must hate).

Figure 1. Compare and contrast

But at least that allows me not to be surprised by Friday’s reaction in the Markets, when a 0.2%pt “beat” in the euro area inflation brought the EURUSD back to previous highs. Remember the days when higher inflation was bad news? Me neither.

“Thinking 360 degrees” around the policy tools… doesn’t bring you far. Data-dependent? Or forecast dependent? We get updated staff forecasts from ECB meeting this week, likely unchanged inflation (1.3%) for 2015, including the new for 2016, probably higher (beauty of models). The latter not important anyway – seriously, would ECB change their mind now based on the 2016 forecast which, afraid to say, will unlikely materialize anyway? The ECB will stay put this week, comforted by the stable inflation, still positive survey/sentiment data, and the money market well behaved, also the curve – e.g. the 1Y1Y EONIA back to pre-May’13-taper-talk levels. With the rates as low as they are, there is nothing ECB can do to meaningfully affect the EURUSD. Sorry.

Figure 2. Inflation…bottom’s up?

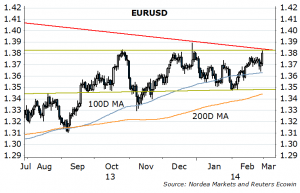

The USD attempted defence failed last week. No changes in outlook from me – as discussed last week, range/higher stocks, UST yields, EMs, cyclicals, weaker USD agaist majors in the near term. The DXY has rejected the important resistance around 80.50, next support line at 79.60, and then it is headed toward 78, which means the EURUSD, now having almost reached the first 1.3840 target (the downtrend from 2008), once breaches it, is on the way to 1.4200. On the downside, the picture changes at around 1.3630, take early profit at 1.3610.

Figure 3. Comfort zone ends at 1.3840

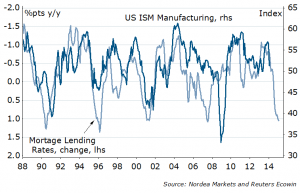

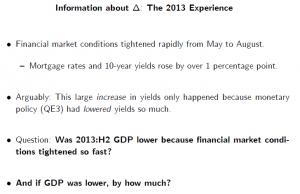

For once, the US ISM print is no less interesting than payrolls. Regional surveys suggest a drop to 50.5 from 51.3. Remember my most important chart of the year I contributed to Business Insider in December (Figure 4)? Fed’s Kocherlakota was talking on Friday, hinting that the sharp rise in rates last year could have been one reason for data weakness (Figure 5, but read all). Payrolls this week (Nordea: 130k, consensus: 150k). Remember the drill: bad – weather. Good – economy. Just don’t be too surprised if good news will lift the stocks and the EURUSD. The unemployment rate is close to hitting 6.5%, but hey: “the 6.5 percent threshold will soon become irrelevant, and it probably is already.” (Plosser on Friday). Not the first time they do it: remember, just last May Bernanke suggested QE would stop by the time we hit 7%? Credibility…

Figure 4. Weather or not weather

Figure 5. Fed’s Kocherlakota on effects of rate rise…

The GBP longs get longer, good news priced in; GBPUSD will keep edging higher on the weaker USD, not getting involved. Rather, keep EURGBP long. Those who are short were trying to see some Vodafone/Verizon M&A related flow to push EURGBP…didn’t happen. The BoE keeps talking about no urgency to hike rates, and eventual hikes – only gradual. Policy on hold this week.

Russian Spring…As you may have understood by now, the situation in Ukraine, while discomforting, does not change my outlook for markets and currencies. I do believe the risk aversion, if any, will be short-lived and limited to the markets concerned. Of course, if stocks decline on Monday/Tuesday purely on technical reasons you will see lots of headlines on Ukraine…sure better than “BREAKING: stocks decline on Fed tapering”. In any case, if things turn really sour, my short USDJPY position will benefit, but CHF will strenghten against. So hedged. As said before, I would rather worry about further worsening of cyclical US and Chinese data.

In commodities space, hold the short NOKSEK, long USDCAD, long AUDNZD. Central bank meetings this week in most – BoC, RBA, RBNZ – two first potential nonevents (neutral-dovish bias, no change), and the market discounts almost a full rate hike from RBNZ. It’s milk prices, stupid!

Nordea