“Far from complete” recovery in the labour market, according to Fed’s new Chair Yellen…So “low for longer”? Then look at, for example, this chart out below. Interestingly, “bottoming” in the initial jobless claims: in previous cycles this was at cycle peaks, when Fed was done HIKING rates!

Figure 1. This time is different

Disappointing again, US retail sales, industrial production last week…and optimists (even Fed – even Bullard) stick to blaming the weather. Probably that hope has kept the risk sentiment together so far. Weather or not, uncertainty band is wide, and two months of data misses now puts the market expectation bar even higher for the following months – hopes for “pent up” demand. Scary, if it doesn’t come – three data points would make a trend. Unexpected to many, better GDP report from the euro area last week (1.1%!), and so far data suggests Q1 for 2014 has more upside risks for euro area vs US. This week’s European PMIs should remain at high levels, still. From the US, housing market data is key, don’t expect much good news. The USD got crushed across the board last week – except for RUB, BRL, KZT… pretty much everything went up. It would be a shame for USD not to try push back this week. But not for long, against majors: having failed at the 80.50, the 80.00 is next key level and the 78 is very likely, which implies (hold your breath) EURUSD at 1.42. But first things first, next short term hurdle at 1.3715/30.

Figure 2. US housing market…weather

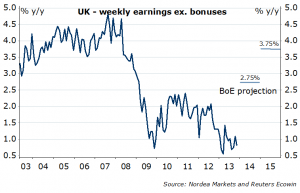

“Excess capacity”…new threshold? It has been repeated 29 times by BoE’s chief Carney last week (10 in the Opening remarks and 19 in the Q&A, to be precise). And yes, they are not indifferent to GBP strength: “net export performance is the most difficult…There is the persistent strength of – the strength of sterling…adds to those challenges. “ The unemployment threshold is gone for good, and now we need to focus on “just” 18 variables the BoE published forecasts on. I would single out wage growth (Figure 3). The jobs report this week is key: we got quite used to sharp drops in unemployment lately, expect no big change this time – could be enough to push the GBP weaker. If not that, then the retail sales (December figures were way too strong to be true, in my view). Technically, the GBPUSD looks like a likely “broadening top”. Note: see the GBP as “risky” for now (even against EUR: EURGBP correlation with S&P 500 changes over the 3M is minus 0.55). I was too early long EURGBP last week, I admit, but once again am, on that same rationale.

Figure 3. We are not there…yet

Japan…struggling to figure out whether quantitative easing is good or bad, as BoJ’s Kiuchi warned of negative side effects last week. Agreed. So far – the JPY-fuelled inflation and worsening trade balance (J curve?!) – another record deficit hit will likely be reported this week. Even machinery orders, which were generally strong last year, recorded biggest plunge since 1992 in December (ehm… weather?). But, most importantly, consumer confidence: people expect jobs, but not income? Shame on you, <insert Japanese company name>. BoJ? Meeting this Tuesday and, as the saying goes, “if you don’t know what to do – do nothing”. Keeping the USDJPY short, targeting sub-100.

Figure 4. Not a happy consumer

On the risky side…some short covering over the last week, potential reversal this week, still mostly dislike Asian EM – KRW, PHP, SGD, MYR and even CNY – not only short term. The EURSEK, EURNOK held important supports last week and so far uptrends in-tact. Finally we got somewhat softer housing data from New Zealand, and more of the same likely from Canada this week. If anything, would stick with the AUD relative longs (vs NZD, CAD)…disappointing AU employment data was…you guessed…due to weather (too hot, you know!).

Figure 5. Too bad to be true?

Nordea