The “good old” risk off…where Emerging Markets can no longer blame “taper”. As feared, the below 50 mark in the Chinese PMI, a few wobbles in US data… and off we go.

EM weakening as USD rates decline… a blast from the past

Demand for “safe haven” currencies picks up precisely when they least need it – amidst the struggle against disinflation. The BoC last week hinted that the currency is still too strong; RBA’s Ridout said on Friday that the AUD hasn’t fallen “far enough”; BoE’s Carney flashed at Davos that GBP appreciation “will hold back the expansion of net exports”…Guess what the RBNZ will say this week as they keep the policy rate unchanged? (Short NZD).

Nobody wants to be a “safe haven”…but some just have to.

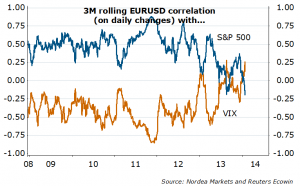

EUR “safe haven” feature is the other side of the “preferred funding currency” coin: since the “taper” talk in May 2013, the EUR has been mostly bid vs USD upon stock market weakness. EMU inflation is out this Friday’, biggest risk to EUR – January inflation never easy to guesstimate (“discounts” vs “administrative hikes”). Market positions for the 0.9% y/y (both headline and core), but whisper expectation is a lower reading. Remember, Draghi noted in latest meeting that inflation is “expected to remain at around current levels in the coming months”. Thus a +/-0.1%pt won’t change the policy course, especially as inflation expectations are still steady. Moreover, the ECB faces less pressure to act now that the money market has normalized somewhat, with EONIA overnight rate back to the internest rate corridor over the past week. Hold on to the EURUSD long (from 1.3450) as it managed to bounce from the 100D MA, for a go above 1.3850. It won’t be pretty above 1.40, be warned (once again).

EURUSD higher in the “risk off” – new normal?

EURUSD does it again…defying the 100D moving average

Woman power…as Bernanke hands over to Yellen this week, likely keeping “low profile” in the last FOMC meeting, with no press conference or outlook changes. The US consumer confidence is worth keeping an eye on – it has been a key drag on the US leading economic indicator lately, and labor market could dent the sentiment. With the 1.3 million people cut off the emergency unemployment benefits this month (potentials for “not in labor force”), we may hit the unemployment threshold faster. But with softer data, the Fed will need to change language, putting more emphasis on wages/inflation. Speaking of which, we do get the Fed’s preferred PCE inflation measure out this week – consensus expects 1.1% y/y, too bad for USD if below. Oh, and by the way: “taper” of USD 10bn is the “measured” step everyone expects from FOMC this week (41/45 Bloomberg survey).

Operation (language) twist…Hitting the threshold is necessary but not sufficient condition to signal rate hikes, is now a clear signal from the BoE. With the UK unemployment rate at 7.1%, close to the 7% threshold, at least BoE’s Carney is honest: “we don’t know how much capacity was destroyed following the crisis”. And even though Carney is to speak again this week, it is unlikely we will get more flesh on the changes in forward guidance until the Inflation Report on February 12th, something which Carney also flagged (“re-examination”). For now we only know that weak productivity, capex and wage inflation growth will not allow the BoE to start tightening. The EURGBP to continue higher toward 0.8350/8400 from here, and if the GBPUSD goes up …that will be mostly the USD rather than the GBP story for now.

Beware…non-commercial market “net long” GBP

Symbolically enough, JPY went stronger last week just after PM Abe declared “Japan is Back” at Davos.Mea Culpa… if I failed to convince you to short USDJPY at 105, we are now nearing the first target of 101.5. As told last week, they can’t afford more currency weakness and… surprise surprise, IMF comments that further JPY decline unlikely come along. Good news: it’s not too late to get to like JPY, as it can get more ugly soon. What was last year’s “survival of the year” trade for many, could be a “nail in the coffin” to those not willing to adapt… All the good things come to an end.

Nordea