Year 5, and counting…

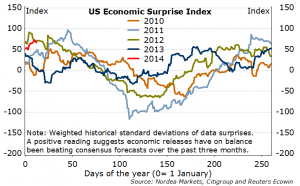

Figure 1. Unsurprisingly surprising

Weird, isn’t it? But I take it at face value. A streak of positive US macro data behind us, raises the threshold for further positive surprises – tailwind for bonds, headwind for stocks going forward. And…USD? Admittedly, last year’s UST yield-USD strong negative correlation has faded a little, with USD stronger on lower UST yields in recent few weeks…flow to the US long-term Treasuries (me in)?

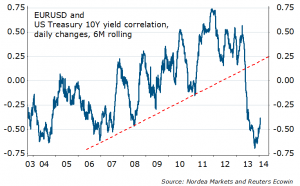

Figure 2. EURUSD and UST correlation – wind of change…

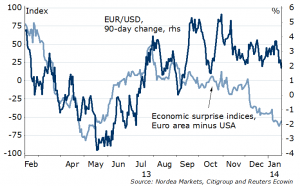

Looking at relative data surprises, it does seem the US outperformance has been one of the key drags for EURUSD recently, and if there is any data this week to move the balance in EUR favour, it’s European PMIs – indicators pointing to further pickup near term, an edge higher (to 52.5) this time around. This, coupled with stable and improving inflation expectations (survey and inflation swaps, options), suggests no urgency for ECB to cut rates – against more analysts calling for it last week (with some juice from ECB – French Cœuré’s comments). France is getting uncomfortable, staying behind the pack in recovery, so expect more squealing. The EURUSD broke the 100D MA, but moves ahead of the US holiday-Monday, calm data and silent Fed week should not be over-interpreted, big changes unlikely this week. Keep the EURUSD long, 1.3450 is crucial support (entry), SL at 1.3340, aiming for 1.3850 in weeks.

Figure 3. EURUSD has faltered on relative data surprises

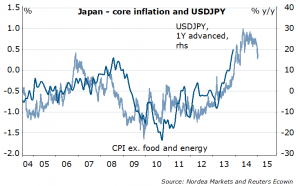

Figure 4. Hanging there…

Take with a pinch of salt week’s fabulous UK retail sales data (volatile and too good relative to other data). This week – the all-important labour market prints, drop of unemployment rate is widely expected, indicators indeed show the 7% to be hit in the coming few months. As expected, inflation has come down, and there is room for more – disinflation should comfort the BoE (excuse to delay rate hikes). The balance of growth – great BoE’s Broadbent’s speech, highlighting the missing links for the BoE, the wage and capex growth, expected evidence of sustained recovery – a lead-in to February’s Inflation Report. Short term EURGBP still supported around 0.8200/8250, and GBPUSD “overshooting” last week may correct this week… but it will remain a buy-on-dip pair with a bit longer horizon (next target 1.66, downside capped to 1.6200/6250). Strategically, keep the GBPCHF long (trade of the year).

Big in Japan… or bigger? More QE signals are expected from the BoJ near term, meeting Wednesday. The 3% pt tax hike in April will be headwind for the economy in Q2. BoJ’s Kuroda indicated a “yes” to more easing recently, but only “if needed” – so don’t put the cart before the horse. And it could be more challenging this time around. Notable US Treasury Secretary Lew’s comments last week: “We still have to see what the so-called third arrow of their policies are <…> long-term growth can’t be rooted in…reliance on unfair advantage because of exchange rate.” After JPY weakening 20%-25% vs USD and EUR last year, and US, EMU struggling with low inflation (e.g. import price from Japan at -3.4% y/y in Dec, lowest since 2002), do you seriously consider it likely for them (read: G10) to accept (read: close eyes to) another round of massive JPY weakening? Especially when we see softer cyclical survey/growth data. Holding USDJPY short (from 105).

Figure 5. Abenomics so far..

Heads up for commodities camp… risks from Chinese data this week, starting Monday, but key – PMI on Thursday (on the brink of 50…).The Bank of Canada meeting on Wednesday, and with the weakness in domestic demand and too low inflation, they will likely strike a dovish tone. And yet, the survey data hasn’t been that bad lately, import inflation is feeding in, the CAD net shorts are record high. The first target, the 1.10, (USDCAD long from 1.0378) was almost hit last week, and tactical profit taking is warranted here. That said, even a short term correction down should be taken as a chance to position for a move much higher (potentially even 1.20) levels in the coming year.

Overreaction to Australian volatile employment data (heat?) last week, but the AUDUSD technical levels breached, opening way for lower lows. Still like the AUDNZD long (trade of the year), also AUDCAD, and keep the NZDUSD short from last year – alternatively, the NZDJPY which broke down the upward trending wedge last week. The NOKSEK has breached another key level, 1.05, keep the short (parity is the ultimate stop). For EMs like ZAR and RUB, you know the drill: heads they lose, tails EUR(USD) win. When Sochi Olympics is the only hope…you know you gotta run.

Nordea