Let’s start from the core. Bernanke almost has no choice here but to act dove on June 19th FOMC meeting – or else, none of us can peacefully go on summer holiday (without work smartphones). It seems by now many expect Bernanke to sound dovish and try to calm the markets down this Wednesday, explain that tapering is not tightening as a minimum. The big risk thus is that Fed hints tapering already in summer (including June!) in size exceeding some USD 15-20bn/month.

You know the worry is on high level when you hear IMF prompting to keep up the QE in large for now while continuing preparation to exit “smoothly”. At all times in history each major chaotic event is preceded by policymakers trying to calm us (and themselves) down. How on Earth can you prepare for a “smooth” exit smoothly? It’s like getting immunity to a virus without being vaccinated.

Another overlooked detail in the IMF’s Article IV statement on the US released on Friday was the message on the USD about value, which goes against many’s conviction “long USD” trade this year:

“The modest dollar overvaluation could be unwound and the external position strengthened through a gradual but sustained reduction in the budget deficit, accompanied by some depreciation of the dollar and adjustment in partner countries’ policies geared towards global rebalancing.”

…I got a flashback to the good old 2004-2007 when everyone was talking about diversification from the USD on large deficits. (Never say never again).

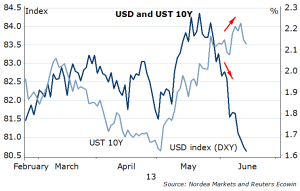

I showed you the graph for some weeks now – correlation between the USD and US Treasury yields – suggesting we are in the regime where higher UST rates are associated with stronger USD and stronger equities, as we move toward Fed tapering. But I still got some confused emails and phone calls regarding the direction indicated: “how come the weaker USD can happen with lower equity prices?” Well yes, it can (Figure 1).

Figure 1. USD index and S&P 500

That being said, it is interesting to observe that over the last week or so we had a few episodes of higher UST yields, weaker USD, lower US stocks and higher volatility… – panic and “liquidation mode”, which the US Fed should worry about most. Not sure all the stop/losses are taken by now, but hearing pain here and there. The long USD speculative long positions were trimmed a bit, but stil are at record highs. I bet the Fed will manage to calm the markets down somehow this week, hopefully G8 officials will also contribute with something, the UST yields will stabilize/go lower, and we continue in the regime where lower UST yields (baseline) would imply weaker USD.

Figure 2. USD index and US Treasury 10 year yield

JPY is getting bigger. How much is enough? Last week I pointed to the 92 as the USDJPY level to target. Jumped on a short USDJPY again at 95.90 (first entry was at 100.50), and still keep ½ of it. Just below the 92.50-93 is an important psychological area – that’s where the BoJ announced their bazooka (QQE) on April 4. Too bad if it goes below. No, this is not just about JPY. This is about the perception of Abenomics. And the QE in general. Poor Japan, history repeats again (you may have read my blogpost on Japan’s QE1 experience by now). The Fed making no big changes to exit strategy nor signaling imminent QE exit this week, coupled by some comments from G8/BoJ, would help stabilize the USDJPY. But come a larger selloff in stocks or, more importantly, really bad news from elsewhere (keep an eye on China’s housing/lending market) in the weeks ahead, the USDJPY will crash to below 90.

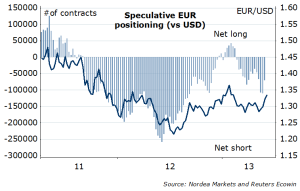

The USD index (DXY) closed below the important 81 last week. The EURUSD and GBPUSD moved closer toward short term targets (1.3400, 1.5800), and I keep those until further notice. The GBPUSD needs to establish above the 1.5700 (200D MA, channel top), or else, retreat toward 1.5500. A small new EURUSD long (from 1.3290, SL 1.3240, TP 1.3400). The 1.3400-1.3450 is important resistance, but if taken then – hello again, 1.3713. Note, the EUR shorts are still alive (Figure 3). European PMIs on Thursday – most important data point. Both PMIs and industrial production have already moved the desired way, and by now I guess many have adjusted their expectations up a bit. But, sure, the upward trend in the EMU economic surprise index has more room to go (Figure 4), in EUR favour. The EUR is already the best perfoming major currency so far this year (unbelievable, isn’t it?).

Figure 3. Speculative EUR positions vs EURUSD

Figure 4. EMU economic surprise index

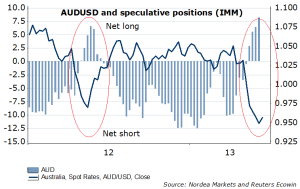

And last but not least. In expectation of some stabilization I like to try buy AUDUSD again for a bounce (thinking 0.9800), as last week AUDUSD showed some corrective action, and closed higher for the week. Déjà vu with the last year (Figure 5)?

Figure 5. AUDUSD and speculative positions

Nordea