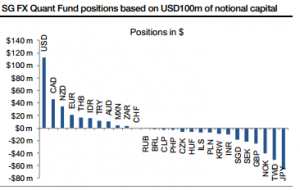

Over the past week, the SG FX Enhanced Risk Premia strategy has increased its long CAD and short NOK positions, and the long AUD position has been reduced. The biggest long remains the dollar, followed by the longs in CAD, NZD and EUR. The biggest shorts are JPY, TWD, NOK and GBP. The short position in GBP/USD and the long positions in USD/JPY and USD/NOK are the USD crosses with the highest combined momentum and IRdriven FX signals among the G10 currencies.

The standard SG Sentiment indicator has stayed in the risk-neutral zone and even briefly broken into the risk-loving area. We have a long exposure to carry in all the regions – G10, EM and Asia. The G10 and EM carry baskets have smaller risk on board than their respective budgets due to negative momentum signals.