In regards to the US economy the message after the July round of data is clear: gradual progress in the strength of the economic recovery persists.

At the same time July’s payrolls release had little bits for both the hawks and doves. The combination of a weak headline number and soft wage growth were enough to give the doves a sigh of relief. Indeed while the trend in economic growth steadily progresses, the trend in wages suggest that labour market slack persists.

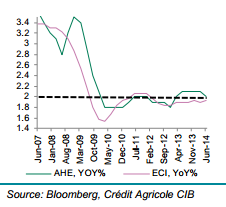

We note that the two broadest measures of wages (average hourly earnings and the employment cost index) both remain stuck below 2.0% – compared to a pre-crisis average above 3.0%. We expect wage growth to increase as the recovery matures but in the near-term this dynamic also reduces the odds of a policy shift from the Fed at this month’s Jackson Hole symposium.

However, the bits under the hood of the July report showed steady improvement in the labour market. While NFP’s 3-month average dropped to 245k from 277k, the 6-month moving average now stands at 244k – the highest level since 2006. What’s more the YoY change in payrolls ticked up nearly 2% in July, which is at a near decade high. And finally, following the revisions to Q1 GDP and the upside surprise in Q2, 6-month moving in GDP now stands at 2.4% – just shy of a cyclical high.

As we enter the lull period in August, we think the balance of risks remains supportive for risk sentiment for now and still look to sell USD/ against the high-yielders on rallies ahead of Jackson Hole (August 21- 23). That said, over the next couple of months we look for a meaningful USD rally and would look to get USD exposure ahead of September’s FOMC meeting, especially against currencies of accommodative central banks.