A busy data calendar is slated for the week ahead, bringing a series of major risk events for USD.

First, and most importantly, is the July employment report. High frequency data, such as the initial jobless claims, paints a picture of a strong labor market, which is also confirmed by some of the monthly survey measures as well. As such, payrolls are likely to remain close to the recent trend, with the market expecting a rise of 231k.

Second, under the hood, the key detail to keep your eye on is the change in wage growth (average hourly earnings). Here, the market expects a flat read for July but the annualized rate is seen rising 2.2% YoY. Given base effects a rise above 2.2% will be needed to keep the market excited.

While we do not expect a sustainable rally in USD to take hold yet, tightening labor market conditions are likely to translate into higher inflation in time. What’s more, we also think technical pressures and positioning adjustments will limit a potential breakout in the USD for now.

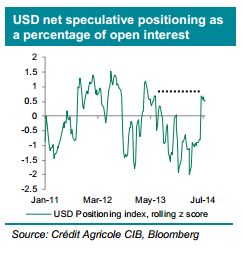

The DXY index, for one, is trading two standard deviations above its 30mma – a level consistent with short-tern correction risks. Other technical indicators, such as RSI and MACD, also call for a mild correction. At the same time speculative positioning (net long as a percentage of open interest) shows USD long’s at levels not seen since this time last year.

This argues for a mild pullback in USD in the near-term despite the potential for strong data releases. At minimum this provides a top to the recent uptrend.