The basic message was broadly unchanged: Key ECB interest rates will remain at present levels for an extended period of time, the Governing Council is unanimous in its commitment to also using unconventional instruments within its mandate, should it become necessary to further address risks of too prolonged a period of low inflation, the targeted long-term refinancing operations (TLTROs) are in the pipeline, while the ECB has also started to intensify preparatory work related to outright purchases in the ABS market to enhance the functioning of the monetary policy transmission mechanism.

ECB optimistic on the TLTROs – threshold for further easing high

The ECB released more details on the TLTROs announced last month. Draghi said the maximum uptake could reach EUR 1000bn, i.e. roughly equalling the 3-year LTROs. He added the TLTROs would be very helpful in lifting the inflation rate back to target, while they would boost growth as well. In other words, the threshold for further near-term easing is very high, as the ECB seems to expect a lot from the operations. The allotments on the TLTROs in September and December will provide some information, but their effect on lending will not be seen until 2015. As a result, unless the inflation outlook changes materially, the ECB will stay in a monitoring mode for now.

It was also interesting that Draghi commented on the components of inflation, implicitly in an effort to point out that core inflation had edged up in June. However, inflation pressures remain subdued for now, and it would be too early to conclude that inflation has hit its lows.

There will be two lending benchmarks for the TLTROs. For banks that exhibited positive eligible net lending in the year to April 2014, the benchmark for the TLTROs is zero. For banks that exhibited negative net lending in the year to April 2014, the benchmark is equal to the extrapolated trend in the year to April 2015, and zero after April 2016. In other words, the details make participation more attractive for the banks that are deleveraging.

Banks that borrow in the TLTROs and fail to achieve their benchmarks as at 30 April 2016 will be required to pay back their borrowings in full in September 2016, while participating banks will face specific reporting obligations. There is no other penalty for not meeting the lending conditions, so at a minimum the funding is secured for two years (or until September 2016).

The first operations will take place on 18 September and 11 December 2014, while additional operations will be conducted in March, June, September and December 2015 and March & June 2016.

Less meetings, more transparency

Draghi announced that starting in early 2015, the ECB would move into a 6-week interval regarding monetary policy meetings, while it would start publishing accounts of its meeting, starting from the first meeting of next year. He justified the decision by saying that the ECB should not act every month, but was sure to remind that the ECB’s job was not finished yet. The reserve maintenance periods will be extended to six weeks as well to match the new schedule.

The details on the accounts were not announced yet, and are unlikely to go as far as to identify by name the individual views of the Governing Council members. The minutes of the previous meeting will be published before the date of the next meeting.

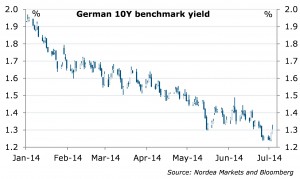

No upside pressure on yields from the Euro zone

Yields and rates remain at exceptionally low levels. As inflation pressures remain very muted, the ECB’s actions support low rates, while even the PMIs have started to lose momentum lately, more significant upside pressure on yields is unlikely to surface from the Euro zone. The US outlook is quite different, though, and higher US rates over the summer should pull also longer EUR yields up.

In terms of intra-Euro-zone spreads, the easy central bank policy should contribute to more spread narrowing, but it will not be a one-way street any longer, and volatility will be higher.

Regarding the euro, the ECB’s actions are not set to weaken the currency any time soon.

There was a sizable market reaction at the time of the ECB press conference, but it was due to the US labour market report. Nothing Draghi said moved the markets much. However, as the meeting was over, e.g. the German 10-year yield took back all of its losses due to the positive US payrolls.

Long yields risen a bit lately, but remain low

Nordea