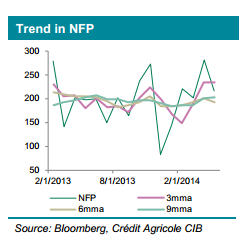

A shortened-holiday week will conclude tomorrow with the June employment report. We forecast a rise of 250k in June – up from a 215k estimate prior to the ADP report. Given the outsized gains in ADP, we suspect that the market consensus is also higher than the 215k listed on Bloomberg. Indeed, the average of the forecasts submitted after ADP is 228 and a standard deviation of 30k. In our view, the revised forecasts provide a better estimate of the market’s expectations and are likely a better benchmark for the USD’s reaction.

Ultimately, we think USD’s reaction to the release will be asymmetric and is likely to have a stronger (negative) reaction to a weaker print.

For instance, for the six payroll reports in 2014 the USD (proxied by DXY) was more sensitive to downside surprises than upside surprises. The average return for a one standard upside surprise was 0.21% against a decline of 0.37% for a one standard deviation miss. The USD’s response is also similar for two standard deviation surprise over 2014 and for the past year.

With this in mind, we think it will take a payrolls print near 300K to spark a broad-based USD rally while anything near or below consensus should remain of the status quo, boosting high-yielding G10 and EM currencies.

Moreover, a payrolls print north of 300 should inspire confidence that a Fed rate hike may come sooner than expected, prompting a rise in USD and a correction in higher-yielding G10 and EM currencies. Even so, an outcome in line with our expectations would see the USD trade on the back foot for now.