USD/JPY continues to frustrate bulls as it hovers at key long-term support at its 200 day moving average (MA) – currently at 101.70, notes BNP Paribas.

This level, according to BNP, has proven to be pivotal for USD/JPY over recent years, and as such BNP believes that the next move for USD/JPY is to the upside.

“The 200-day MA has been key in providing support for the pair and in our view remains an attractive entry point for establishing long positions and we target 105.50 on our long USDJPY trade recommendation,” BNP advises.

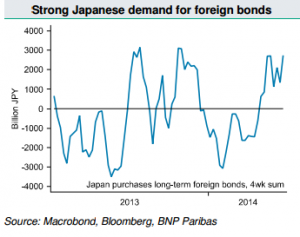

Moreover, BNP thinks that the strong Japanese demand for foreign bonds suggests USD/JPY is set to to bounce.

“Data out this morning again highlights that Japanese investor are accelerating purchases of foreign securities. Weekly purchases of foreign bonds were JPY 1,486 billion for the week ending June 20 – the second highest weekly purchases this year and a new high for the 4-week moving sum,” BNP notes.