Barclays’ rationale behind the short EUR/GBP trade is as follows:

‘”This remains one of our favoured trades, as a way to express a structural bearish view on the EUR and the robust growth outlook and move towards policy normalization in the UK. Our 12m target remains 0.77. We are somewhat more cautious on chasing GBPUSD significantly higher from current levels but remain broadly constructive, in line with Technical Strategy,” Barcalys calrifies.

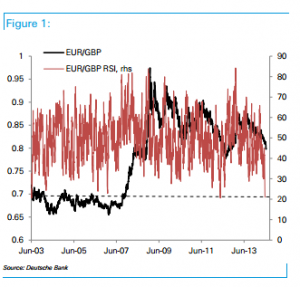

Deutsche Bank’s rationle behind the long EUR/GBP trade is as follows:

“The cross is the most technically stretched it has been in history, reaching the 20 level on a 14 day RSI (see chart). EUR yields have now caught up with the fall in EONIA post-ECB and should not drop further, while it is difficult to see market pricing getting any more aggressive for UK rate hikes. Also slowdown in housing data should weigh on the pound over the next few months,” Deutsche Bank clarifies.