The UK provides an encouraging template of the tradable opportunities that arrive where growth and/or inflation develops sustained momentum, notes Credit Suisse.

“With opportunities to find yield across the G10 still highly limited, we think the medium-term challenges for the UK are unlikely to discourage further currency appreciation,” CS argues.

How to play it? Macro views:

“We note, however, that the market prices upside sterling risk into the skew of many currency pairs, leaving limited upside exposure for GBP/USD or EUR/GBP our preferred expression for the next stage of the move,” CS notes.

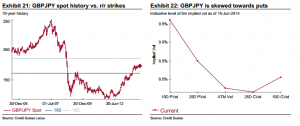

By contrast, CS thinks that GBP/JPY offers more potential as an expression of the return of macro opportunity and policy divergence later in the year.

“The one pair where we think there is scope for a significant new leg higher is in GBPJPY. The reason for our view is that we think policy divergence has larger scope to be reopened as we see think additional BoJ stimulus may be announced at around the same time as our economists think the BoE may be tightening,” CS clarifies.

Technicals: GBP/USD.

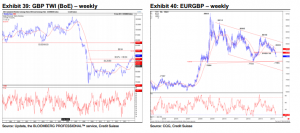

“For GBPUSD, the spotlight remains firmly on critical price resistance at 1.7044/49 – the 2005 low and 2009 high. Whilst the importance of this barrier should not be under-estimated, we will continue to view setbacks from here as corrective ahead of an eventual sustained break here, for a move to our 1.7332 long-held target – the 50% retracement of the 2007/2009 collapse. Whilst we would continue to look for further consolidation to emerge from here, we now look for a break above here in due course also, to clear the way for strength to extend to 1.8235 – the 61.8% retracement of the 2007/2009 bear trend,” CS projects.

Technicals: GBP/JPY.

“We also watch GBPJPY, where a large bullish “triangle” continuation pattern may be close to completing. Above 173.60/66 should add weight to this view, but ultimately, suspect we need the 2014 high at 174.86 to be cleared to confirm. If this can be achieved though, we would look for this to provide the platform for a potentially significant bull phase, with 184 seen as our initial target – the 50% retracement of the 2007/2011 bear market,” CS notes.

Technicals: EUR/GBP:

“Given our bearish stance on the EUR as well, EURGBP clearly stands out as a key vehicle to express this view. Indeed, we have maintained a core bearish outlook here, with the market now well below pivotal support (and our initial bear target) at .8165/55 – the “neckline” to the 2012 base, 61.8% retracement of the 2012/2013 bull trend, and January and February lows. Support at .7982/61 is currently holding – the 78.6% retracement of the 2012/2013 rally and late 2012 low – but we look for a break below here in due course and for weakness extend to the lower end of the medium-term range and our core bear target at .7800/.7755. While we would expect a fresh floor here, if our view on the TWI is correct, this would suggest there is a real risk this could also be removed in due course, to target .7255,” CS adds.