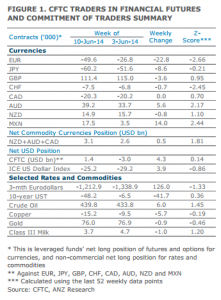

The following are the key points in ANZ’s analysis for the latest speculative positioning report (positioning data is for the week ending 10 June.

Bearish EUR bets rose to their highest since late-May 2013 following the 5 June ECB meeting which saw the introduction of a negative deposit rate, targeted LTROs and unsterilised SMP. Net short positions in EUR/USD increased by 22.8k contracts (worth USD3.8bn) to 49.6k (USD8.4bn). The last time net positioning was at this level, EUR/USD was trading closer towards 1.30. For now, EUR/USD is supported above 1.35 and it would require a further increase in short bets to break below that level.

Net short positions in JPY rose by 8.6k contracts to 60.2k, ahead of the 13 June BoJ decision. However, USD/JPY is not moving as much in line with positioning changes this year compared to the past.

Leveraged funds reduced their net long positions in NZD for the fifth consecutive week heading into the 12 June RBNZ Monetary Policy Statement. The positioning change no doubt reflected market expectations that the RBNZ would be dovish. Hence, it was not surprising to see the rally in NZD/USD post the hawkish statement as long positions were reinstated.

The continual decline in iron ore prices continue to be shrugged off by leveraged funds, who increased their net long positions in AUD by 5.6k contracts (worth USD0.6bn) to 39.2k (USD3.7bn). On a relative basis, net long AUD/NZD positions are at their highest level since late-April 2013.

Net long positioning in GBP reduced by 3.6k contracts to 111.4k, though this was before BoE Governor Carney’s remarks that rate rises “could happen sooner than markets currently expect”. Bullish GBP bets will remain elevated and may even reach record highs following Carney’s rate rise remarks.