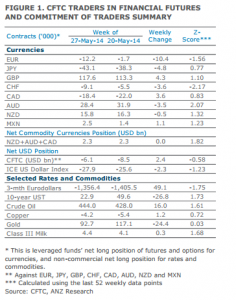

Leveraged funds increased their short bets against the EUR on expectations of policy easing at the upcoming 5 June meeting. Short positions increased by 10.4k contracts (worth USD1.8bn) to 12.2k (totalling USD2.1bn). The downward move in EUR/USD has been consistent with this positioning move.

The market is now discounting a 15bp interest rate cut, the introduction of a negative deposit rate and some form of conditional liquidity for banks. Should the Governing Council fall short of expectations, we will see short EUR positions get unwound, leading to a near-term rally in the euro.

The positioning change in EUR resulted in a reduction in net short positions against the USD for the third consecutive week. However, positioning in the ICE USD contract, which is a direct bet on the direction of the DXY Index, showed an increase in short positions. Positioning in USD based on the implied CFTC and ICE data have diverged since mid-term direction of the USD is mixed.

AUD net long positions fell after rising for two consecutive weeks, but remained elevated. Net long positioning decreased by 3.5k contracts (USD0.3bn) to 28.4k, in line with the slight fall in AUD/USD. However, given the recent sharp falls in iron ore prices, the risk of long AUD positions getting unwound is rising.

Net long positioning in GBP rose for the second consecutive week (by 4.3k contracts to 117.6k), while short positions against CHF increased to the highest level since June 2013 at 9.1k contracts.