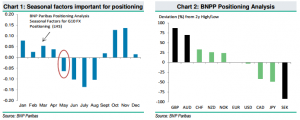

Large currency exposures tend to be scaled back between May and August according to BNP Paribas’ FX Positioning Analysis.

The methodology:

“We use BNP Paribas positioning analysis to indicate the extent to which the market is long or short currencies in the G10. An extreme long or short position indicates vulnerability in the market if there is a change in the fundamental story for a currency, while light positioning generally indicates there is scope for the market to enter new positions. Our analysis also indicates how much risk is allocated to the FX market,” BNPP clarifies.

The findings:

“We find that the total allocation is subject to seasonal change and that May is the start of a period when positioning tends to be reduced. The seasonal factors in Chart 1 show a clear pattern. Risk tends to be allocated at the start of the year from January through to April. During the summer months our positioning analysis suggests a scaling back of risk allocations, and then an increase through September to November,” BNPP finds out.

The picks: most vulnerable positions in May:

“While general participation in FX has been low in recent months, there are several positions that we think may be sensitive to seasonal unwinding: long GBP, long AUD and short SEK,”BNPP concludes.